Following an early shaky start, which saw the Hang Seng tumble as much as 1.6% driven by weakness in financials and real estate names following the latest warning by PBOC governor Zhou about “sudden, complex, hidden, contagious, hazardous” risks In markets and a decline in local real estate prices, and pressure global risk, US equity futures have recouped all losses and are back to unchanged on Monday morning, as President Trump continues on his first official trip to Asia. An “anti-corruption” purge in Saudi Arabia, including the arrest of Prince Alwaleed bin Talal will put stocks including Citigroup, Twitter and Apple – some of his major holdings – in focus according to Bloomberg. it also helped sent oil prices to the highest level since July 2015. In company news, talks between Sprint’s majority owner, SoftBank, to combine the carrier with T-Mobile US collapsed over the weekend.

Following a torrid weekend for newsflow, when among other things we learned that NY Fed president Bill Dudley is retiring, Monday morning has been a far more subdued affair, and European markets have enjoyed a quiet start to the week, apart from ongoing speculation over Dudley’s departure; USD unwinds small overnight rally, with USD/JPY retracing gains seen after Trump’s comments on trade initially weakens JPY; GBP/USD approaches high set on Friday in reaction to non-farm payrolls. European stocks hold small losses across the board, banks underperforms. Telecom sector also weakens after Deutsche Telekom falls 3.7%, spurred by collapse of the Sprint/T-Mobile deal. Overnight gains in iron ore futures helped support mining stocks and other base metals. As Bloomberg’s rates commentators note, reduced supply this week drives up core EGBs, led by bund futures; USTs rise in tandem. Large BTP/bund block trade pushes peripheral spreads marginally wider.

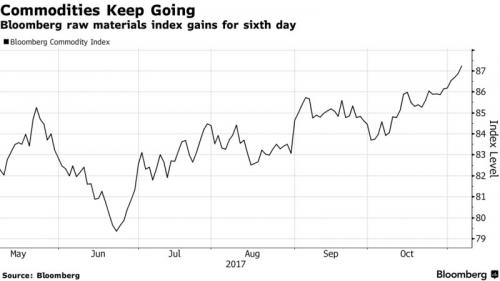

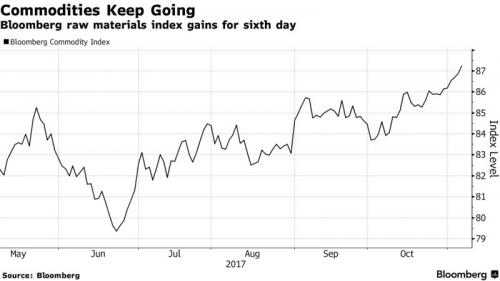

European stocks were mixed before edging slightly lower after their seventh weekly advance in eight, even as the latest European PMI prints indicated strong survey momentum has continued at the start of the fourth quarter. Basic resource shares outperformed as the Bloomberg Commodity Index rose to the highest since March, but they were offset by retreating banks and telecom companies.

The Stoxx Europe 600 Index fell less than 0.1%, with miners headed for their highest level since January 2013, and leading gains as they track metal prices higher. SBM Offshore slides after making a provision of $238m in relation to a reopened investigation into legacy issues and Unaoil, based on discussions with the U.S. Department of Justice.

News out of Asia was a dominant theme for many assets, with inflation comments from Bank of Japan Governor Haruhiko Kuroda, remarks on excessive leverage from his Chinese counterpart Zhou Xiaochuan and the grievances on trade from Trump. The yen declined before erasing the loss, and stocks in the region were mixed. Asian stocks edged lower for a second consecutive session after China’s central bank Governor sudden, complex, hidden, contagious, hazardous. The MSCI Asia Pacific Index was down 0.1% to 169.72. Financial stocks led the decline, with AIA Group Ltd. being one of the biggest drags. Westpac Banking Corp. also fell after its full-year profit missed estimates. The Topix index retreated from the highest level in more than a decade as technical indicators suggest the gauge is overheating.

“Zhou highlighting concerns of excess leverage and thus more regulation is weighing down on stocks,” said James Soutter, a Melbourne-based fund manager at K2 Asset Management Ltd. “If they do that, it might slow down China’s growth, which may impact the region.” Gains by technology stocks such as Tencent Holdings Ltd. and Sony Corp. helped pare the earlier decline of as much as 0.6 percent in MSCI’s broadest gauge of Asian stocks. MISC Bhd rose as much as 8 percent, the most in four years, after reporting a surge in profit for the third quarter. Analysts upgraded the stock after highlighting improvement in all business

Oh, and speaking of that Hang Seng early drop, don’t worry: the BTFDers emerged, and Hong Kong’s benchmark gauge erased a drop of as much as 1.6% to close little changed. AAC Technologies Holdings and Tencent Holdings climbed while the city’s developers slumped; AAC Technologies surges 10% to a record price, while Tencent adds 2.5%. As a result, the Hang Seng Index closes little changed at 28,596.80 even as Hang Seng China Enterprises Index dropped 0.7%, paring an earlier loss of 2%. Additionally, the Shanghai Composite Index adds 0.5%, erasing a retreat of 0.5% while the ChiNext Index added 1%.

Among the key weekend events, a helicopter transporting eight Saudi officials including Prince Mansour bin Muqrin (Deputy Governor of the Asir Province) reportedly crashed near Abha. Additionally, Prince Alaweed bin Talal who is the largest shareholder of Citi and the second largest shareholderof 21st Century Fox was among ten other princes and four ministers were arrested on Saturday night. This has been billed as a corruption crackdown, although what it really is, is a power grab from Crown Prince Mohammed bin Salman.

In the UK, Chancellor Hammond is said to scrap plans to raise business rate tax by 3.9% in April.Bank of England Governor Carney said that if Brexit turned out to be worse than policymakers currently expect, it was possible that the BoE would not be able to cut interest rates in the future due to inflationary pressure.

Meanwhile in Japan, President Trump said that TPP agreement is not the right idea, adding that the US has suffered massive trade deficits at hands of Japan for many years.

U.S. 10-year Treasuries find support from rally in core and peripheral bonds in Europe; bund futures extend gains on higher volumes after stop losses are triggered on short positions; currency traders fail to find inspiration as majors are trapped in narrow ranges; euro dips briefly after interbank investors add to long dollar positions, though better-than-forecast euro-area PMI for October staves off a bigger drop for the common currency

In commodities, WTI gained 0.6 percent to $55.97 a barrel, the highest in about nine months. Gold increased 0.1 percent to $1,271.66 an ounce. Copper rose 1 percent to $3.15 a pound, the highest in more than a week.

Leave A Comment