Last week was full of interesting economic data. I analyze them to show that gold bulls have to be patient. The data suggest that the US economy remains healthy. So far.

Inflationary Pressure Eases

On August the 24th, 2018, we published Gold News Monitor in which we wondered whether inflation has peaked. Now, we know the answer: it indeed peaked in July. The CPI has reached 2.7 percent in August over the last 12 months, a slowdown from 2.9 percent in the previous month, as one can see in the chart below. It was the first decline in annual rate in almost a year. The yearly change in the core CPI, which excludes food and energy, also decelerated from 2.4 to 2.2 percent.

Chart 1: U.S. CPI (green line, annual % change) and core CPI (red line, annual % change) from August 2013 to August 2018.

On a monthly basis, the CPI rose 0.2 percent, the fifth straight increase. It was the same change as in July. The core index increased 0.1 percent, following 0.2-percent rise in the previous month. Overall, the inflationary pressure eased somewhat in August. However, inflation remains slightly above the Fed’s target.

Retail Sales Rise Modestly

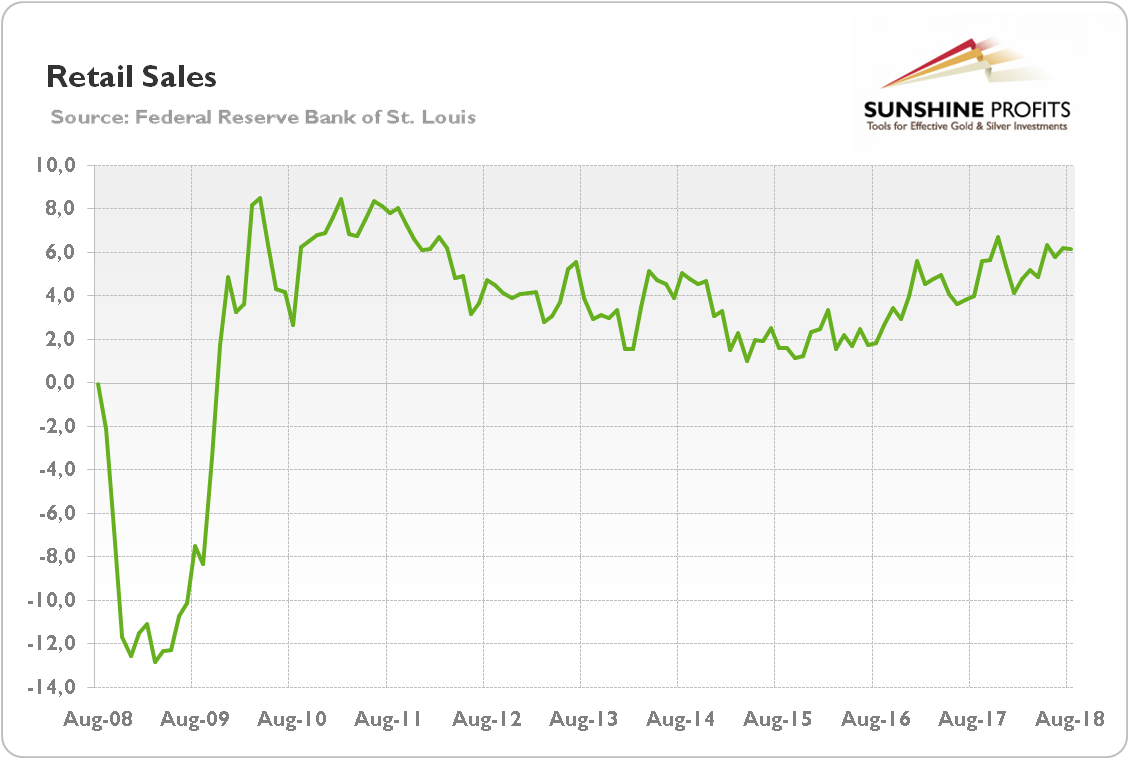

Retail sales rose only by 0.1 percent in August. However, a scant increase followed 0.7 percent jump in July, so it is understandable. Moreover, the retail sales have surged 6.6 percent over the last 12 months. The advance retail sales excluding food services jumped 6.2 percent, as the chart below shows.

Chart 2: Retail sales (advance numbers; excluding food services, annual % change) from August 2008 to August 2018.

The chart suggests that the US retail sector remains generally solid. It should not be surprising as fundamentals behind the consumer spending are positive: strong job gains, accelerating wage growth (we covered this issue last week), improving household balance sheets, and increasing wealth due to the rising asset prices.

Industrial Production Positively Surprises

Leave A Comment