Through Thursday of this past week, Gold for all the world was yet again reprising its rendition of

“Nowhere Man”

–(The Beatles, ’65), apparently en route to a fourth consecutive weekly net change of less than 10 points.

But then come Thursday evening was the termination of the “Sell the rumour” (from back in mid-October’s Gold peak at 1308) and “Buy the news” (as our House of Representatives passed their version of the tax bill). For in now turning to the Senate with their own version and expectations of tax bill dissent, in came the doubt, leading to a Dollar rout, and thus Gold garnered some clout in settling out the week yesterday (Friday) at 1294, its best weekly gain (+19 points or +1.5%) in the last five.

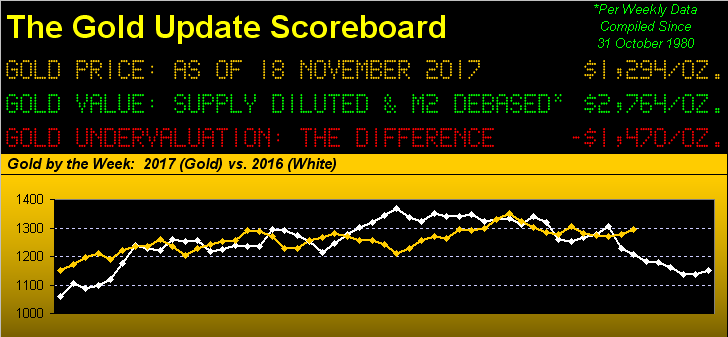

Moreover in glancing at the opening graphic of the Gold Scoreboard, price is now 7.2% above where ’twas at this time a year ago (1207): that’s the highest percentage difference ‘twixt the two tracks since mid-January, and further, this year’s price is now bending upward rather than retracing last year’s flopping finale.

‘Course in 2017, there are still six trading weeks to run: plenty of time for price to again succumb. But ’tis somewhat gratifying to see Gold (as we say in Formula One) “get some grunt in its lump”, on Friday having spritely run up and out of The Box (1280-1240); we write “somewhat” as price’s still being sub-2000 at this point in the currency debasement cycle remains an inane absurdity, indeed an illogicity not found anywhere else in nature. Fortunately, the eventual reversion to debasement’s mean, (by our scoreboard 2764), shall put the scales of monetary justice back in balance.

“And then there’s the overshoot, right mmb?”

Right, Squire. But Assignment One is to reclaim Base Camp 1377 (2016’s high trade) which as we turn to the weekly bars remains quite high in the sky above the descending red dots of parabolic Short trend. But is it out of reach by year’s end? Gold’s present price of 1294 need rise 6.4% to reach 1377 within this year’s final six weeks: for the 16 completed years in this millennium, Gold locked in gains of better than that percentage during the final six weeks of 2002, 2005, 2007 and 2008. On average, that’s once every four years … but ’tis not occurred in the last eight. Can you say “overdue“? To be sure ‘twould be a nice holiday present:

Leave A Comment