It seems that the yellow metal is trying to close the last trading of 2017 higher, as the gold prices achieved gains pushing the price toward 1280 an ounce, the highest level in the current month, and the gold is now closer to test the psychologically important peak at $1300.

The gold took advantage of the US index, which measures the greenback’s strength against a basket of 6 currencies, retreating towards 92.96, and the drop of the US stock market, to achieve gains. The gold is moving within upward channel as shown on the daily chart, but within tight ranges, even with the strong pressures on the dollar after the passage of the US tax cut bill. It seems that the increased move towards crypto-currencies after the recent record gains, especially the for the Bitcoin, contributed to reduced interest in buying gold, as the recent gains were lower than usual in light of a lower dollar.

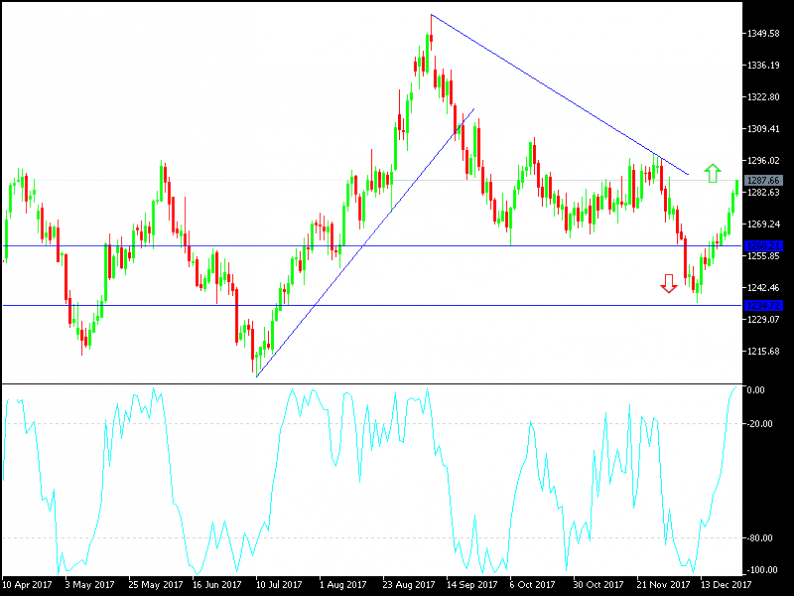

Technically:

Gold prices will have a strong bullish move today if the prices moved towards the resistance level at 1285, the psychological peak at 1300. The nearest support levels for gold are currently at 1272, 1265 and 1253. We still prefer buying the gold from every bearish level. In light of market closer due to holidays this week and early next week for Christmas and New Year, traders need to be alert of price gaps due to markets coming back in interrupted form sometimes, and it is better to avoid trading until the markets are fully back to normal.

On the economic data front today:

The gold will have full focus on the dollar’s level and the reaction to the US unemployment claims, good’s trade balance and the Chicago PMI. The gold will also monitor updates regarding renewed geopolitical fears regarding North Korea, BREXIT or Trump’s economic policy.

Leave A Comment