The world is awash in debt, and it’s simply unsustainable. As worldwide debt levels keep setting new records, there’s no chance anyone will ever be paid back.

Even “vampire squid” Goldman Sachs Group Inc., with its tentacles deep into bond markets, thinks so.

The world’s central banks now have an insurmountable dilemma: Raising interest rates will just increase the repayment burden. Keeping them low will only inflate the debt bubbles all over.

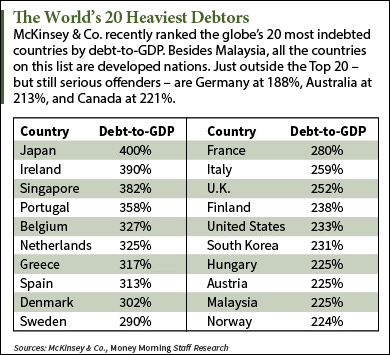

The sovereign debt crises we’ve seen over the last six years have triggered major sell-offs, but odds are high this $200 trillion global problem could start the mother of them all.

But I’m going to show you how to make a killing as the bill comes due…

Government Debt Is the “Bubbliest” of All

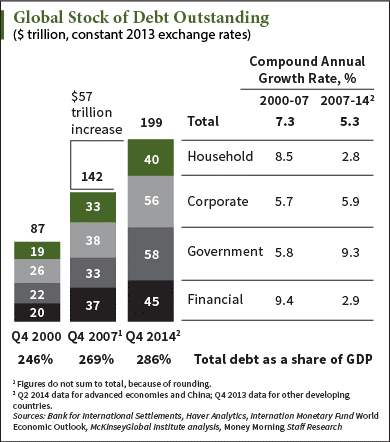

Global debt has mushroomed by $57 trillion since the financial crisis, and that’s only up to the end of 2014.

You can see that government debt, mostly accrued in an effort to stimulate the developed world’s floundering economies, accounts for the lions’ share of this astronomical bill.

One of the most salient points of this chart is that while debt is up by a stunning 40% since 2007, the world has gone from debt at an already massive 246% of GDP in 2000 to 286% of GDP in 2014.

And how have we benefited? We haven’t.

Economic output has clearly not kept pace with all this extra debt.

Even St. Louis Fed Vice President Stephen D. Williamson admitted in a recent white paper that the theory behind quantitative easing (QE) is “not well-developed.”

He suggests that empirical support for Bernanke’s view on how asset purchases affect outcomes is “mixed at best.”

Williamson considers all the relevant research to be problematic and says that “there is no way to determine whether asset prices move in response to a QE announcement simply because of a signaling effect, whereby QE matters not because of the direct effects of the asset swaps, but because it provides information about future central bank actions with respect to the policy interest rate.”

Leave A Comment