The Hershey Company (HSY) is one of the great examples of determination in the history of American business.

Hershey’s founder, Milton S. Hershey, spent his teenage years as an apprentice to a candy maker. Before long, he opened two candy stores—which both eventually went bust.

Milton Hershey went bankrupt twice before the age of 30. But he stuck with his craft, and his resilience paid off.

Hershey transformed the chocolate industry. Previously, chocolate was a luxury reserved for the wealthy. But thanks to his unique milk chocolate recipe, it became something everyone could afford.

Today, Hershey generates over $7 billion in annual sales.

Hershey has a tasty dividend yield of 2.5%, and is a Dividend Achiever in the making. It has raised its dividend each year since 2010. With only a few more, it will join the Dividend Achievers – stocks with 10+ consecutive years of dividend increases.

You can see the entire list of all 273 Dividend Achievers here.

Hershey has paid 348 consecutive quarterly dividends. Going forward, it can continue to grow its dividend each year. The only downside for the stock is that it has a valuation that is not very appetizing.

Business Overview

Hershey is a chocolate manufacturer. It employs approximately 21,000 people. Hershey has a very large product portfolio, with more than 80 brands.

The company operates in two main segments, which are based on geographic markets:

The North America segment includes the U.S. and Canada. The International & Other segment is comprised of various nations in Asia, Latin America, Africa, Europe, and the Middle East.

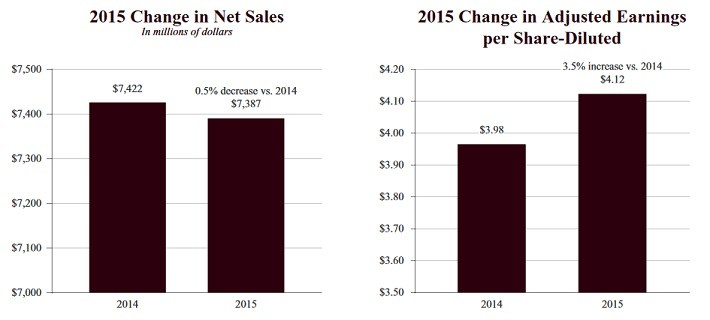

2015 was a challenging year for Hershey. Sales declined by 0.5%.

Source: 2015 Annual Report, page 52

Hershey did not perform up to its own expectations heading into the 2015 Annual Report. Management had forecast 5.5%-7.5% sales growth.

The silver lining for last year could be that much of the damage was due to unfavorable currency fluctuations. The strong U.S. dollar is negatively impacting Hershey’s international operations.

Leave A Comment