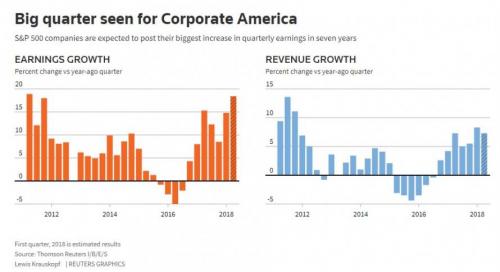

While the main event this week will be the official start of Q1 earnings season which is expected to be blockbuster, if mainly at the EPS level thanks to Trump’s corporate tax cut, the biggest risk overhang remains the escalating trade war with China, and specifically Beijing’s retaliation to the unexpected Trump escalation in which he told the USTR to consider an additional $100BN in tariffs for a $150BN total.

As previously discussed, one potential complication in the Chinese retaliation is that the US does not have $150BN in exports to China, which means that Beijing will need to get creative in crafting its escalating response.

That said, China has no less than previously discussedhow to escalate, the problem being however that all five are what some have dubbed “nuclear” choices, and include:

A Currency Depreciation. A sharp, one-time yuan devaluation, like the one Beijing unexpectedly carried out in August 2015, could be used to offset some of the effect of tariffs.

Sales of US Treasurys. Chinese authorities could sell some of its large official-sector holdings of US Treasuries, which would lead to a tightening of US financial conditions.

Block US services. Chinese authorities could limit access for US companies to the Chinese domestic market, particularly in the services sector, where the US exports $56 billion in services annually and runs a $38 billion surplus

Curb US oil shipments. According to Petromatrix, China is one of the biggest importers of U.S. crude oil at 400kb/d, so any counter-tariffs on crude could become very heavy for the U.S. supply and demand picture. Such a move would weigh on U.S. prices and spill over to global oil pricing. As Petromatrix adds, the market would need to start balancing downward price risk of trade-war escalations with upside risk of Iran sanctions as oil flows could be about the same.

Blocking rare-earth exports. China has a near global monopoly on the production of rare earths, which are a critical component in all high-tech devices such as cell phones, computers, fighter jets and cruise missiles. In national defense, there is no substitute and no other supply source available. When China blocked rare earth exports to Japan over a territorial spat involving the East China Sea in 2011/2012, the price of rare earths soared.

Leave A Comment