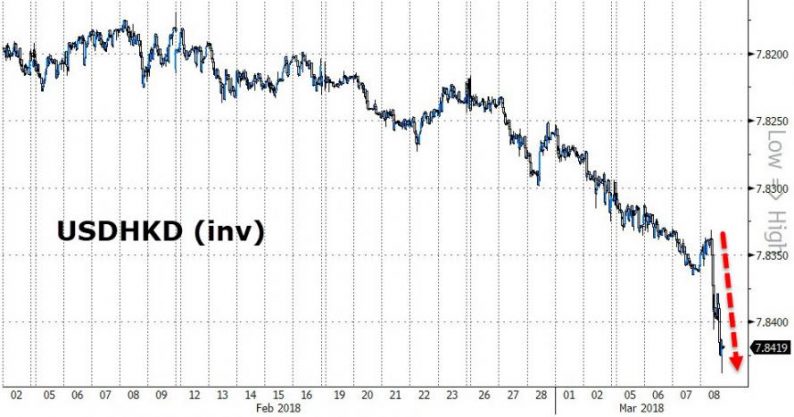

On the same day as Hong Kong Monetary Authority (HKMA) Chief Norman Chan urged citizens to “stay calm on the currency weakening,” the Hong Kong Dollar has plunged to its weakest in 33 years amid liquidity concerns and a global carry trade gone rogue.

The Hong Kong Dollar has been in free-fall for the last year (interrupted briefly in the middle of last year) but as its drop accelerated in recent days, Chief Norman Chan urged citizens to “stay calm on the currency weakening,”:

Stay calm on the weakening of the Hong Kong dollar

There have been concerns and discussions in the market about the recent weakening of the Hong Kong dollar (HKD).

Chan then goes to to answer some questions (but it seems his headline sparked some sudden selling)…

This is the weakest in 30 years and near the weaker end of the peg band (7.85/USD), but do not worry, Chan says:

“However, this should not cause any concerns, as the HKMA will take action when the HKD exchange rate touches the weak-side Convertibility Undertaking (7.85) to ensure that it will not fall below 7.85.“

Question 3 caught our eye – If the HKMA is not concerned about the weakening of the HKD, why did it issue additional Exchange Fund bills when the HKD was weakening last year? Was it intended to prevent the HKD from depreciating as suggested by some market players?

Good question.

His response:

This is not true. The issuance of additional HK$80 billion worth of Exchange Fund bills by the HKMA last time was solely in response to market demand for highly liquid instruments and had nothing to do with the strengthening or weakening of the HKD.

We do not have plans to issue additional Exchange Fund bills for the time being and hope that market players will not take it wrongly that the HKMA does not want the HKD to weaken.

In fact, with the widening of the spreads between HKD and USD interest rates, we are looking forward to funds flowing from the HKD into the USD, causing the HKD exchange rate to reach 7.85, a level where the HKMA will take action. This will allow the Monetary Base to contract gradually and create an environment conducive to the normalisation of HKD interest rates.

Leave A Comment