Honeywell International Inc. (HON – Free Report) reported better-than-expected results for third-quarter 2018.

Earnings & Revenues

Adjusted earnings in the reported quarter were $2.03 per share, outpacing the Zacks Consensus Estimate of $1.99. The bottom line also improved 16.7% year over year. This upside primarily stemmed from the company’s stellar operational performance during the reported quarter.

Revenues of $10,762 million in the third quarter surpassed the Zacks Consensus Estimate of $10,731 million. The top line also grew 6.3% year over year. Top-line numbers improved 7% organically on the back of stronger sales generated from the company’s Aerospace, and Safety and Productivity Solutions businesses.

Segmental Break-Up

Revenues in the Aerospace segment were $4,030 million, up 10% year over year. The top-line performance of the Home and Building Technologies segment improved 2% year over year to $2,517 million. Performance Materials and Technologies segment’s revenues in the third quarter were $2,640 million, up 3% year over year. Safety and Productivity Solutions revenues improved 11% year over year to $1,575 million.

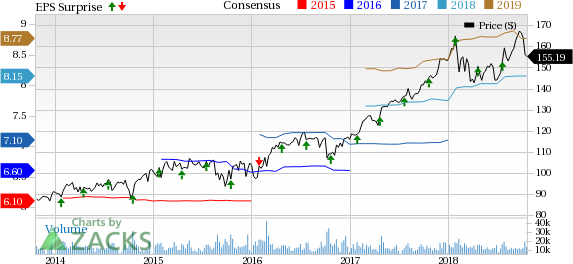

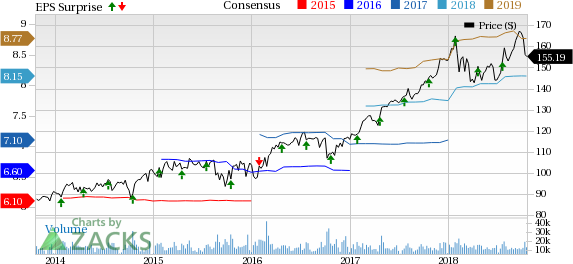

Honeywell International Inc. Price, Consensus and EPS Surprise

Honeywell International Inc. Price, Consensus and EPS Surprise | Honeywell International Inc. Quote

Costs/Margins

The company’s total cost of sales in the reported quarter was $7,556 million, up 7.1% year over year. Selling, general and administrative expenses remained flat year over year at $1,524 million. Interest expenses and other financial charges were $99 million compared with $81 million witnessed in the comparable period last year.

Operating income margin in the third quarter was 15.6%, up 40 basis points year over year.

Balance Sheet/Cash Flow

Exiting the quarter, Honeywell had cash and cash equivalents of $9,803 million, higher than $7,059 million recorded as of Dec 31, 2017. Long-term debt was $14,059 million, higher than $12,573 million recorded at the end of 2017.

Leave A Comment