While inverse vol funds were the immediate catalyst for the February 5 market crash, the market’s recent jittery behavior has coincided, and often been blamed on, the recent uptick in inflation. That said, as Deutsche Bank’s Binky Chadha writes, whether this was cause and effect is debatable. Nonetheless, late in the business cycle with a tight labor market, “strong coordinated growth”, a lower dollar, higher oil prices and a fading of one off factors, all point to inflation moving up.

As a result, two key questions have emerged: What does higher inflation mean for equities? And how long until higher inflation translates into a recession.

Here, Deutsche Bank makes some preliminary observations. First, and conceptually, higher inflation is ambiguous.

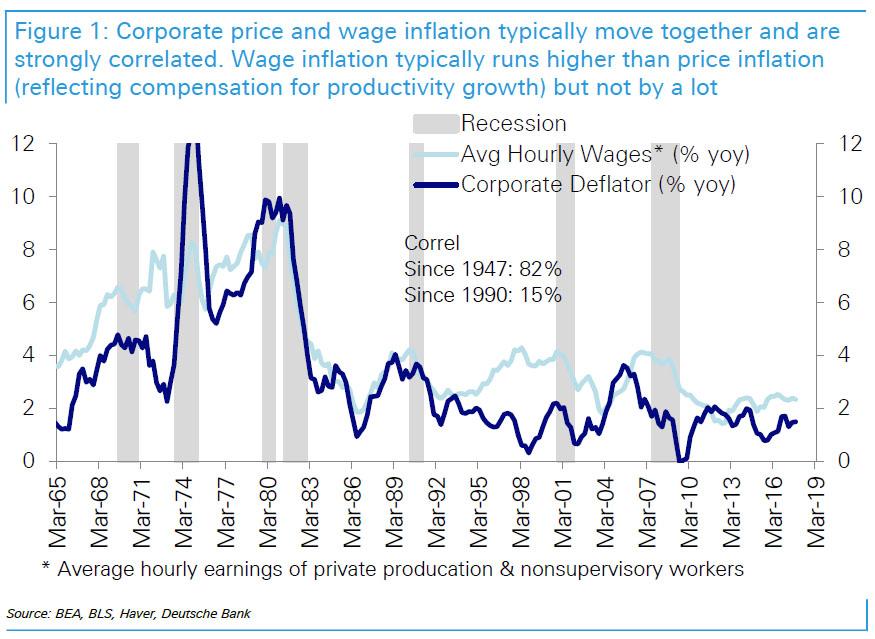

From a pricing vs cost perspective, whether higher inflation leads to higher or lower margins depends on the relative strengths of price vs wage and other input cost inflation. It depends on the relative importance of variable vs fixed costs. And on the extent to which corporates can increase productivity in response to cost pressures. It is notable that while markets seem to have been surprised by the recent uptick in wage inflation, corporates have been noting it for at least a year. Finally, inflation does not occur in a vacuum. The drivers of higher inflation matter and when it reflects strong growth, it implies not only higher sales but operating leverage from fixed costs can raise margins and amplify the impact on earnings.

In other words, inflation in itself is not a death sentence to bull markets. What is just as important is overall economic growth (rising inflation is benign if overall economic growth is higher), as well as the impact of inflation on profit margins – i.e. the ability to pass inflation through to the end consumer – and most importantly, how the Fed reacts to inflation, or namely does the Fed think it is behind the curve.

Ultimately, it all boils down to whether future inflation will be higher (or much higher) than currently.

Leave A Comment