Spotify (SPOT) will begin trading publicly on April 3, but it will not have an IPO. The Swedish streaming service instead plans to do a direct listing of its stock. Employees and investors will be able to sell shares on public markets, but the company itself will not be raising any new capital.

The lack of a traditional IPO process makes it much harder to predict where shares will trade initially. It doesn’t help that shares changed hands at prices ranging from $37.50 to $125 in 2017, according to Spotify’s F-1.

To help investors sort through the confusion, we will present three different proposed valuations for Spotify based on three different scenarios of growth and profitability. We will also explain the strategic challenges the company faces that make the pessimistic scenarios more likely and make the stock this week’s Danger Zone pick.

Owning Content is Key

The biggest challenge Spotify faces is simple. It doesn’t own the music that consumers listen to on its platform. Instead, it licenses the music from major record labels. The “Big 3” record labels—Universal Music, Sony Music, and Warner Music—along with Merlin, which represents a large number of independent artists, accounted for more than 85% of all streams in 2017.

The oligopolistic nature of the music business gives the record labels a significant amount of leverage in negotiations with Spotify. All the major labels have “most favored nations” provisions in their contracts, which means Spotify cannot give more favorable terms to one label without extending those same terms to all the others. In essence, Spotify has to negotiate with the major labels as a unified block.

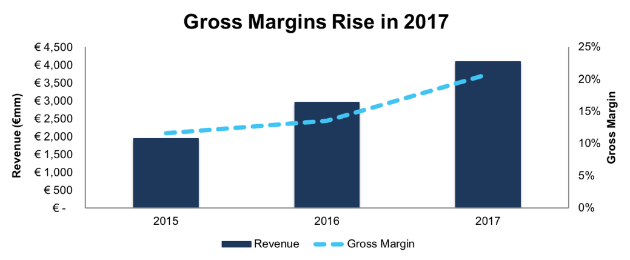

As Figure 1 shows, Spotify managed to negotiate better rates with the labels in 2017, which helped its gross margins improve from 14% to 21%. However, that increase comes with a significant caveat. The major labels all have significant equity positions in Spotify, and they had an incentive to help the company go public faster in order to avoid triggering clauses in its convertible debt that would have diluted their equity. The labels won’t have this same incentive to grant more favorable terms when terms are renegotiated in 2019.

Figure 1: Revenue and Gross Margins for Spotify Since 2015

Sources: New Constructs, LLC and company filings

Spotify has targeted long-term gross margins of 30-35%, but the company may find it difficult to achieve that level of profitability as long as it has to negotiate against a highly-consolidated group of content owners. We expect that the content owners will always aim to maximize their profits on the content. Accordingly, anytime they see Spotify as making too much money, they will raise their prices and compress Spotify’s margins.

Competition Is Increasing

Increased competition from other streaming services, especially Apple Music (AAPL), should also decrease Spotify’s leverage in the future. Although Spotify remains the largest player in the global streaming music market, its competitors are catching up.

A recent report in The Wall Street Journal found that Apple Music has been growing paid subscribers at a monthly rate of 5% versus just 2% for Spotify. At current growth rates, Apple Music will overtake Spotify in terms of paying U.S. subscribers sometime this summer, even as Spotify still has nearly double the number of paying users globally.

Apple Music is the most notable competitor, but Spotify also faces pressure from Amazon Music (AMZN), Google Play Music and YouTube Music (GOOGL), and Pandora (P). If Spotify ever gets too aggressive in its negotiations with record labels, the content owners can always threaten to walk away and just let consumers access their music through these other services.

In addition, Apple, Google, and Amazon can all afford to treat their streaming services as loss leaders to draw users into their platforms. As long as customers buy more HomePods and iPhones, Apple doesn’t care if it makes money on the streaming service itself. As a result, these competitors can easily absorb less favorable terms than Spotify, which eventually needs to earn a profit.

Increased competition has also forced Spotify to lower its prices for consumers. The company’s average revenue per user has declined from €6.84 in 2015 to €5.32 in 2017 as it promotes its “Family Plan” that allows several users to share one account. The lower price helps Spotify retain users but puts more pressure on its margins.

Given that all the major streaming services have fairly comprehensive libraries, the only way Spotify can build a competitive advantage is through music curation and discovery. The company has made a big push to build hyper-specific playlists in order to differentiate itself from the competition, but it remains to be seen if this feature can be a true difference maker.

Leave A Comment