Two weeks ago, we reported that even as U.S. lenders were professing to their investors that there is no risks with their energy exposure and that they are comfortably reserved for any potential losses, they were reducing their unfunded (and total) exposure to oil and gas exploration companies due to balance sheet, default and contagion concerns.

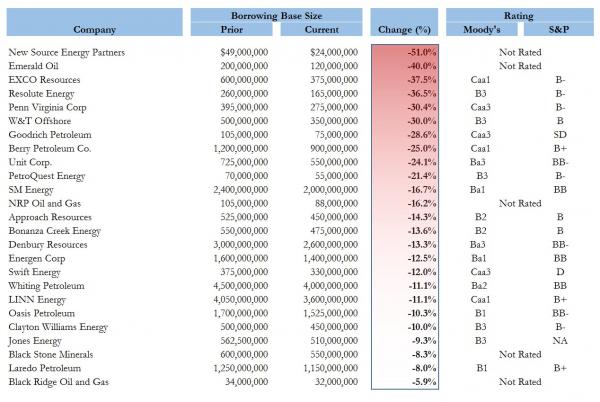

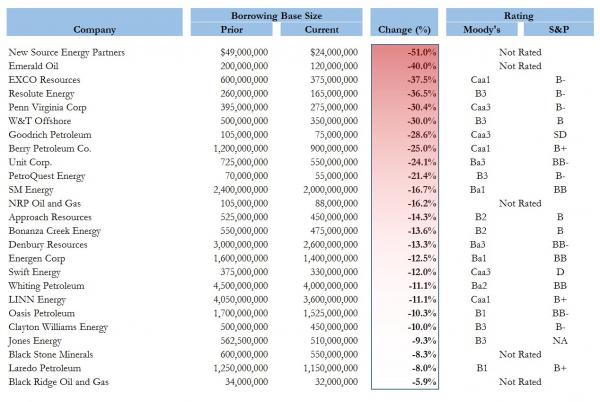

We showed a list 25 deeply distressed companies, whose banks we found have quietly shrunk the borrowing base of their credit facilities anywhere from 6% in the case of Black Ridge Oil and Gas to a whopping 51% for soon to be insolvent New Source Energy Partners.

Following up on this distrubing development, here is Markit with its take on how “Leverage is tightening the noose on US oil firms.”

Evaporating credit lines are set to finally squeeze US energy firms as oil prices break through $30 a barrel and US banks sound the alarm on rising bad loans in the sector.

Continued price declines

After the lifting of sanctions in Iran this week, expectations for increased oil output has put further pressure on oil prices with both Brent and West Texas Intermediate prices dropping to the lowest levels seen this century. In the US, embattled producers are finally being forced to consider ceasing production as banks reign in on credit lines for fear of rising bad debts.

Markit’s Research Signals Financial Leverage factor*, show that US energy firms saw a degradation in their financial leverage position in the last 12 months as energy names saw their average rank rise over this timeframe. The sector’s average ranking increased from 48 to 52 in the past 12 months – as declining earnings crimped the sector’s ability to service its debts.

Leave A Comment