Video Length: 00:03:30

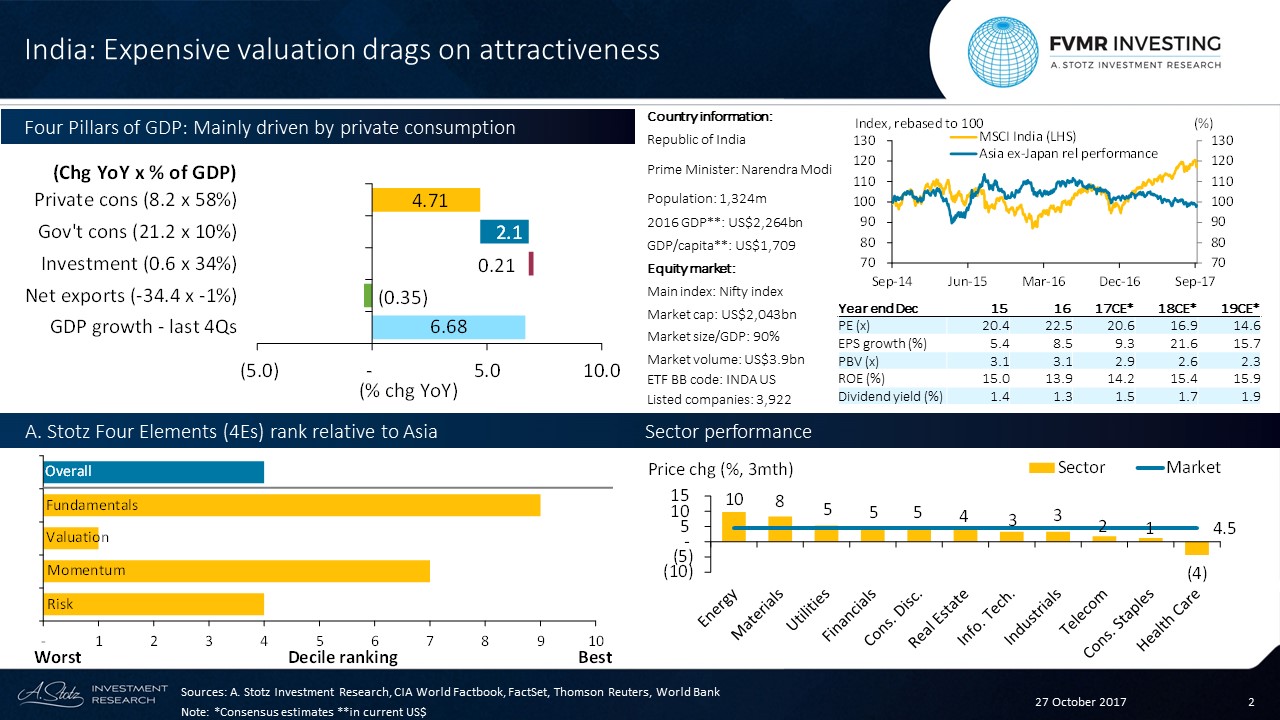

Four Pillars of GDP: Mainly driven by private consumption

GDP in India still grow the fastest in Asia, beat the Philippines by a whisker. This is mainly the result of heavy private consumption, but government consumption growth has also contributed. Net exports dragged on the GDP growth.

Expensive valuation drags on attractiveness

Consensus estimates have India as most expensive in Asia on price-to-book (PB), but India also had the second highest return on equity (ROE) in the past 12 months after Indonesia. The dividend yield is also relatively low.

A. Stotz Four Elements: India’s rank relative to Asia

Overall, India is moderately attractive in Asia considering all our four elements: Fundamentals, Valuation, Momentum, and Risk.

Fundamentals: Great, return on equity has been the second highest in Asia in the past 12 months.

Valuation: The Indian stock market has the highest forward valuation in Asia on price-to-book and second highest on price-to-earnings.

Momentum: Moderate earnings momentum, fairly good price momentum.

Risk: Relatively high beta to the Asia ex Japan index.

Strong performance in Energy and Telecoms

Top 3 largest sectors: Financials: 22% of the market; Consumer Discretionary: 13%; Materials: 13%.

Best sector & stock: Energy: +9.7% & Oil India Ltd: +34.8%

Worst sector & stock: Health Care: -4.4% & Ajanta Pharma Ltd: -27.3%

Leave A Comment