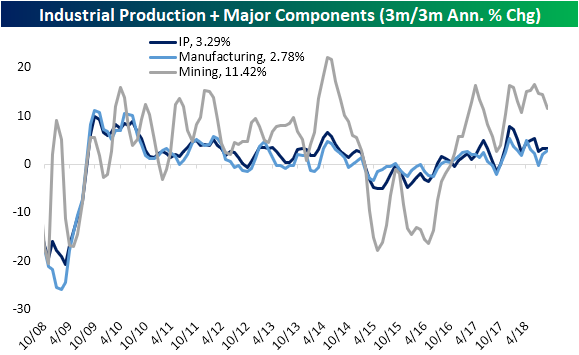

Industrial production growth in September was forecasted to fall to 0.2% from August’s reading of 0.4% MoM. The release for September came in higher than expectations at +0.3%. On a 3m/3m annualized basis, September’s data is still below where it has been for most of the year though. Mining has continued to be a key driver in the aggregate production measure this year. Even with over a 3% decline from the prior period, mining production rose 11.42% on a 3m/3m annualized basis. A big portion of this mining production comes from strength in oil and gas. Manufacturing saw a nice bounce thanks to much stronger automotive production.

On the industry level, we have seen a substantial recovery of autos. As one of the major components that make up aggregate industrial production, it is a good sign to see this industry picking up steam. Only a couple months ago—back in July—the industry was at a multiyear low of -18.01% annualized on a 3m/3m basis. Since then, it has climbed all the way back to 9.79% through September. This comes on the back of September’s stronger than expected auto sales that was released earlier this month. This could bode well for the automotive industry which has been soft since the end of 2017.

Unfortunately, the strength in autos for this month was not reflected in construction supplies which fell again to -1.3% annualized 3m/3m.This is nothing new for this year as many housing and construction data points have been consistently weak.

After bottoming out in 2016, both industrial and manufacturing capacity utilization have been on the move upwards. Industrial capacity utilization has yet to take out its high from back in April, but it has seen consistent moves higher over the course of the past few months. Today’s release forecasted capacity utilization to increase to 78.2%. Instead, September’s release came inline with August at 78.1%. Manufacturing utilization, on the other hand, did surpass its high in September. It is now at its highest level since July 2015. On a longer time frame though, capacity still has not reached pre-recession levels.

Leave A Comment