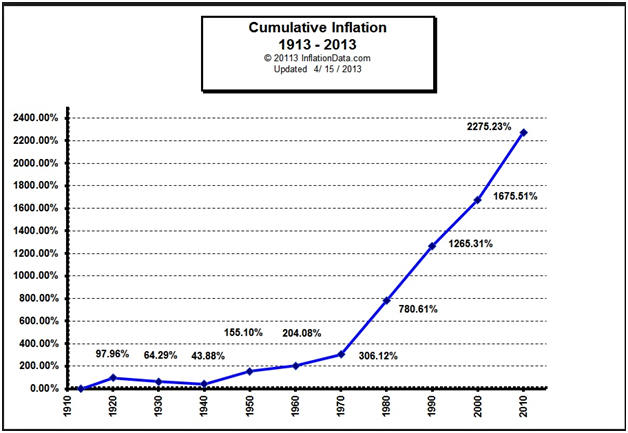

One of the reasons the market has been so volatile lately is the fear of inflation rearing its ugly head. If this forces the Federal Reserve to push up interest rates more than expected, the stock market is in for a serious fall.

Besides its impact on the financial markets, inflation can have a huge impact on a person’s retirement plan.

We know that as inflation rises, so do our expenses. This is one big impact that inflation has on a retirement plan. However, what is overlooked so often is the impact of inflation on the taxes we pay.

Inflation Is A Stealth Tax On Your Social Security

Many people don’t realize that they are taxed twice on their social security. You are taxed on it as income when you are receiving a salary. You will also pay taxes (unless your income is extremely low) on your social security checks in retirement.

Just as bad as the double-taxation scheme, the tax brackets for social security payments are not indexed to inflation. So very soon everybody who receives a social security check will be paying taxes on it. This is one of the stealth taxes that inflation gives us.

The Inflation Tax On Capital Gains

I want to show an example of how inflation generates a stealth tax on capital gains. Let’s say you own a second home that you rent to a family. You paid $100,000 for this home in 2017. In 25 years you sell this home. Over this 25 years, the housing market in your area kept up with the inflation rate of 2.5% per year. That is 85% compounded inflation. This will show up as a “gain” for you when you sell the home, even though your real capital gain is zero. It’s all due to inflation. But you have to pay taxes on it anyway. You will pay nearly $28,000 in capital gains taxes.

Inflation And Your Retirement

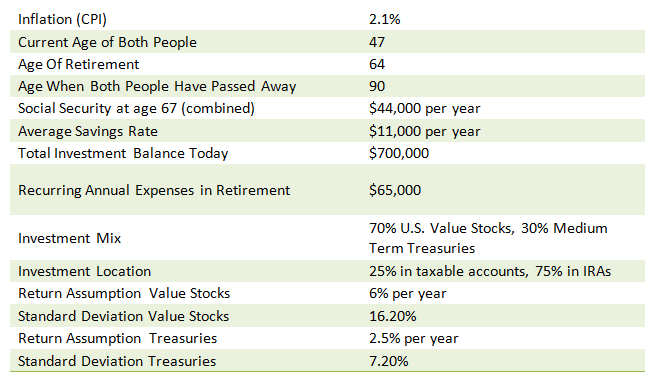

Let’s look at a case study to see how rising inflation impacts a couple’s retirement situation. My assumptions for this couple are below:

I ran this retirement analysis in our WealthTrace Financial & Retirement Planner. It is important to note that as inflation goes up, so do annual returns in my analysis. I do this because in the long run returns for both stocks and bonds move with inflation.

Leave A Comment