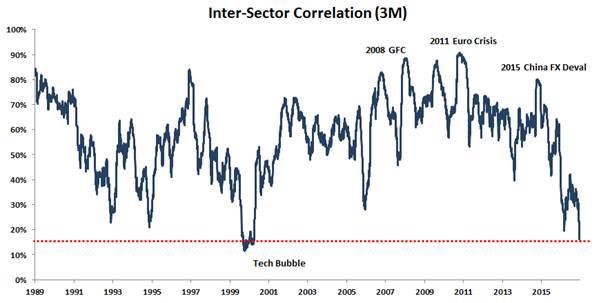

The correlations between sectors have declined in the past few months. This means the market is bifurcated. To uses a common Wall Street phrase, ‘it’s a stock pickers market’.

The correlations may have fallen in 2000 because only the tech stocks were going up. During the financial crisis, all stocks fell which is why correlations were high. An interesting dynamic to consider is that correlations are declining despite all the passive investors buying S&P 500 index funds. It makes you question how much the indexing is affecting the market.

The big question is if this current situation is going to lead to the same crash that occurred in 2000. I don’t see that happening because tech stocks are much cheaper this time around. I can’t think of a sector which is due for a major crash. There will be times of underperformance like I think might happen in oil in the next few weeks, but that would be nothing compared to the collapse in 2014-2015. As you can see, the correlation was low in 1995, yet a crash didn’t occur. This is likely one of those charts which gets famous because of a comparison to a crash period, but doesn’t forecast a crash correctly.

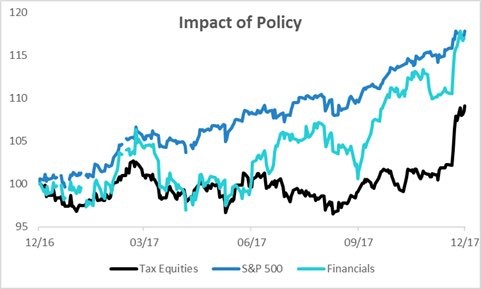

One of the catalysts of the decline in inter-sector correlation is the impact of tax policy. As you can see, firms with high tax rates which will benefit the most from the corporate tax cut have recently started to rally. The high tax stocks and the financials have been outperforming the S&P 500 in the past few weeks. The legislation will likely be priced in, in the next few weeks which means the correlation might return to more normal levels in the 2018.

For the last point on the tax cut, the chart below shows the corporate tax rates of many developed nations. As you can see, the U.S. corporate tax cut to 20% moves it from the highest taxed country to one of the lowest. This is just the statutory rate, not the effective rate. I think America is probably closer to the others in actual taxes paid before this legislation gets passed. The French are also cutting corporate taxes. They are also lowering government spending. The 33.33% corporate tax rate will gradually be cut over the next few years. It will fall to 28% in 2020 and 25% by 2022.

Leave A Comment