(Photo Credit: Fortune Live Media)

Investment banks Goldman Sachs and Morgan Stanley will be reporting their quarterly earnings tomorrow morning. Here’s a look at how they are predicted to fare for Q3.

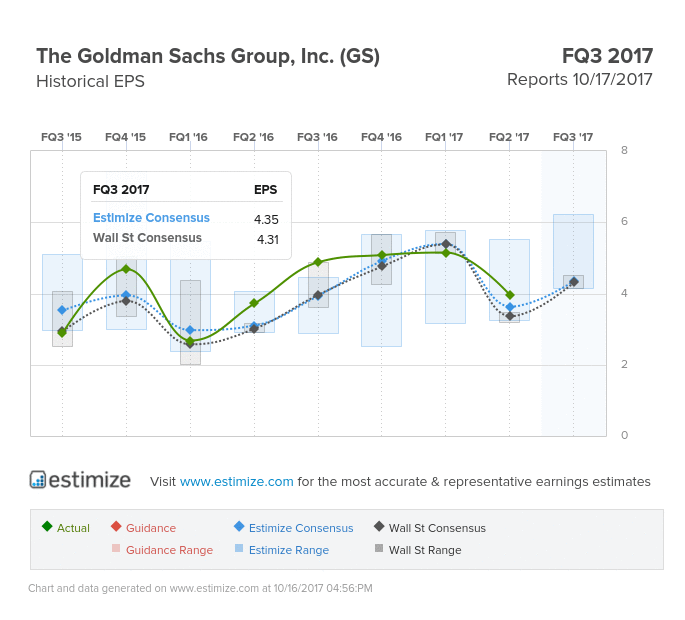

Goldman Sachs (GS)

Financials – Capital Markets | Reports October 17, BMO

After a steady end to 2016 and first quarter of 2017, Goldman Sachs’ EPS fell significantly quarter-over-quarter in Q2, but still increased 6% on a year-over-year basis. Third quarter expectations are predicting the first decline in YoY profits since Q3 2015, with Estimize data showing a fall of 11%, despite recovering 10% since last quarter. Estimize and Wall Street estimate EPS at $4.35 and $4.31 respectively, whilst the Street’s revenue predictions at $7.638B are slightly below Estimize’s estimated $7.547B. By reference, Goldman Sachs tends to beat Estimize 78% and Wall Street 89% of the time in EPS predictions.

In the past week, reports have come out to suggest that the investment bank may be introducing a new trading operation for Bitcoin and other cryptocurrencies. CEO Lloyd Blankfein has remained somewhat tight-lipped about his thoughts on Bitcoin, unlike CEO Jamie Dimon of JPMorgan, who has strongly voiced his skepticism. If it made this shift, Goldman Sachs would be the first major player on Wall Street to do so, and might even see others like Morgan Stanley follow. The investment bank has also recently joined JPMorgan in offering clients new investment products of betting against AT1s (Additional Tier 1 Notes).

Morgan Stanley (MS)

Financials – Capital Markets | Reports October 17, BMO

Like Goldman Sachs, Morgan Stanley too reached a peak in the first quarter before falling and now starting to bounce back. For this quarter, Estimize and Street data predicts EPS to be approximately $0.84 and $0.81, with revenue coming out at $9.066B and $8.947B respectively. MS tends to outperform the Estimize and Wall Street estimates more than 70% of the time. Since the results of the second quarter, Morgan Stanley has shown indications of outperforming its old rival Goldman Sachs, and the recent quarterly results should confirm that. Another positive to take away for Morgan Stanley is their predicted YoY growth, which is predicted to be around 4% for EPS and 2% for revenue.

Leave A Comment