Let’s start with last week’s newsletter:

As I noted in my blog entitled “Eating Sardines”:

“For now, it is important to note the ‘bullish trend’ remains solidly intact and, therefore, we must give the ‘benefit of the doubt’ to the bulls.

The market is currently in the process of building a consolidation pattern as shown by the ‘red’ triangle below. Whichever direction the market breaks out from this consolidation will dictate the direction of the next intermediate-term move.”

Well, on Friday, the market made its move.”

“The breakout of this consolidation is nothing but “bullish” in the short-term and requires us to remove our hedge and allow portfolios to run unencumbered for the time being.

The great “bear market” of 2018 officially ended on Friday…for now.

As I have notated above, there are three possibilities for the market as we wrap up the “seasonally strong” time of the year.

- If the market can clear the previous high from mid-February then an advance to all-time highs is quite likely. (50%)

- The market fails to clear resistance, initially, at the mid-February highs, retraces back to the previous downtrend line (which will likely coincide with the 100-dma), completing a successful retest of the breakout and then moves to towards all-time highs. (30%)

- The market fails at mid-February resistance, tests support, and bounces, but fails at resistance a second time and begins a deeper correction.(20%)

I am giving the greatest odds to option (1) for the time being.

However, option (2) and (3) should not be dismissed either. “

While I gave option (1) the greatest odds, it was option (2) that came to fruition as shown in the updated chart below.

The predicted path of decline, so far, has held at the 50-dma, which is bullish. However, the overbought condition, combined with the previous resistance level, proved too formidable for investors to push the market higher.

More importantly, while the “bullish trend” remains solidly intact, the market did fail at the uptrend resistance line as noted last week.

That failure set up the retracement, and retest of the breakout, which also brought options (2) and (3) into focus.

While I have laid out three different options, there are a multitude of paths the market can take. However, in the end, while the exact pattern that plays out could vary wildly, the market is either going to resume its bullish trend or it will break down.

“No kidding.”

I know that sounds excessively simplistic or that I am just “hedging my bets.”

I’m not. I simply do not know with a great deal of certainty where the markets will go next. There are no guarantees in investing and we are all speculating on potential outcomes with our “hard earned” savings. Since we are confined to a consolidation process, betting solely on a “bullish” outcome is dangerous. This is particularly the case when “sell signals” are registered on an intermediate-term basis.

Since, it is the prevention of the loss of investment capital which is paramount to long-term investing success, erring on the side of caution during uncertain times tends to be the better choice. Yes, you could certainly “miss out” on a bit of an advance, should one occur, but portfolios can be quickly readjusted to participate with further gains. Making up lost capital is a different matter entirely.

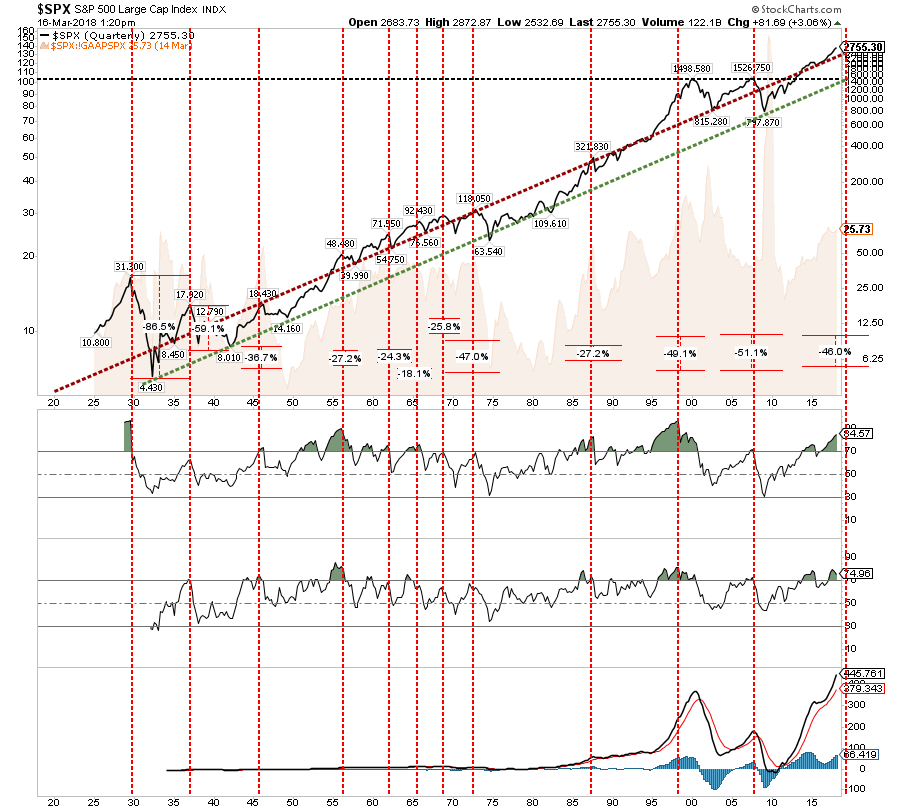

At some point, individuals should question just how much more “juice” there is to squeeze from this particular market given the very overvalued, extended and mature advance. The chart below shows every period where the market, on a quarterly basis, was above its long-term bullish trend line, combined with extremely overbought conditions, and the subsequent correction that occurred.

A correction occurred every time all the conditions were me as indicated by the vertical dashed line. Once again all those conditions are met and the subsequent decline from current lines should theoretically approach 50%.

Leave A Comment