Is it possible for a bear market to occur when the U.S. economy is expanding? Certainly. In fact, most bear markets are already well on their way to becoming 20% price declines long before a recession is formerly identified.

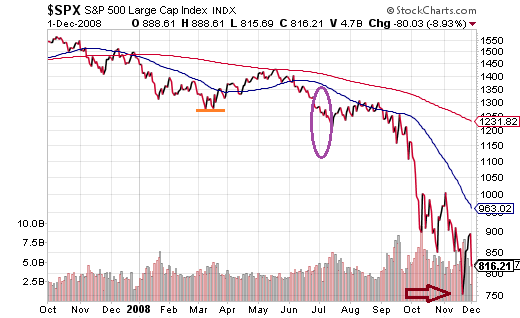

Consider the most recent bearish retreat (10/07 – 3/09). The National Bureau of Economic Research (NBER) officially declared on 12/1/08 that the U.S. recession had started in December of 2007 – a declaration that came nearly one year after the economic downturn’s inception.

Nine months before NBER expressed its “recession” call, the S&P 500 had already plummeted close to the 20% level (March, 2008.) At that moment, the Federal Reserve saved financial markets by joining JP Morgan Chase in bailing out Bear Stearns. Then, in the first week of July, five months before the NBER proclamation, the S&P 500 had descended more than the requisite 20%. And by the time anyone could count on an authenticated recession, the S&P 500 had already plummeted roughly 47.8% – close to half of its entire value.

Well, okay. I suppose that the world’s best economists should err on the side of caution before making hasty decisions. Perhaps NBER, composed of academic economists from Harvard, Stanford and other top-notch universities, were quicker in warning investors prior to the 3/2000-10/2002 tech wreck?

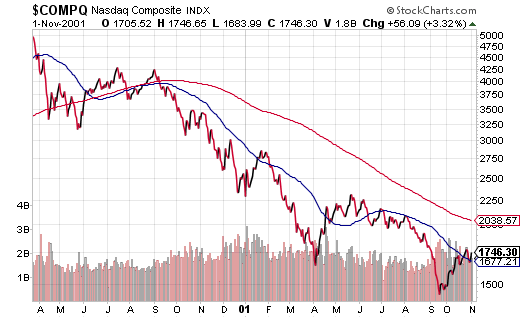

Unfortunately, nine months before NBER expressed a March 2001 recession start in November of 2001, the S&P 500 had already made its bearish descent. (Nine months again?) It gets worse. The S&P 500 had already dropped 29% by November of 2001 and the “New Economy” NASDAQ had already plummeted 65%!

In spite of the obvious evidence that U.S. stock assets tend to fall long before the most prominent minds affirm contraction in the U.S. economy, an overwhelming number of analysts keep exclaiming that there is no recession in sight. And without a recession, they say, there’s not going to be a bear.

Leave A Comment