Well… things are not pretty. Some are even using the word “carnage” to describe current state of the stock markets. However, even though this is one of the worst months of the decade for stocks, if we take a step back, things aren’t all that bad.

The Dow Jones is now sitting almost exactly where it started the year.

In fact, even though volatility is extremely high, some analysts, including Fundstrat’s Tom Lee, are saying that now is the time to buy the dip. Of course, Tom is also saying that bitcoin could end the year at $22,000. So we might need to take his words with a grain of salt.

In any case, the best strategy for such times is usually to not panic. Remain diversified and be nimble. There are plenty of opportunities out there but we do need to choose them carefully.

Today’s Highlights

Traditional Markets

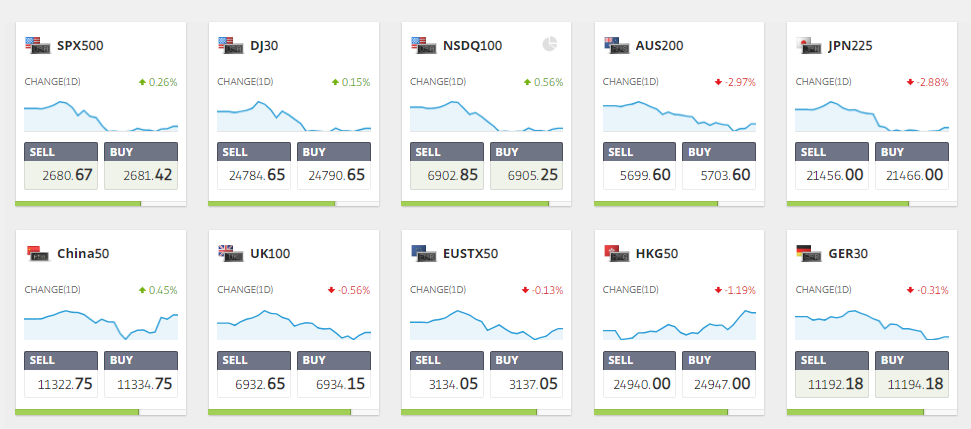

While Asian and European stock indexes have extended the slide this morning, US futures are teasing with green numbers. So a major rally off the lows would not surprise me today.

Gold also took a hit this morning, as did the Japanese Yen, which could mean that the flight to safety is abating.

The US Dollar, on the other hand, is gaining against most of its rivals. Most notably is the Chinese Yuan. Just now we saw the USDCNH popping higher as it inches closer to the $7 level. If that red line is reached it could likely draw comments from the American White House.

Draghi Day

The Euro is also dropping today, this ahead of the all-important ECB rate decision. Nobody expects any major policy changes from the European Central Bank today, and likewise, now is not exactly the time to start throwing surprises at the market.

In fact, I’m rather hoping that Mario Draghi’s smooth monotonous voice will go a long way to calm investors nerves today.

Leave A Comment