The BLS Job Openings and Labor Turnover Survey (JOLTS) can be used as a predictor of future jobs growth, and the predictive elements show that the private non-farm job opening growth rate declined slightly. However, the current rate is quite high – so the high employment growth currently being seen should continue.

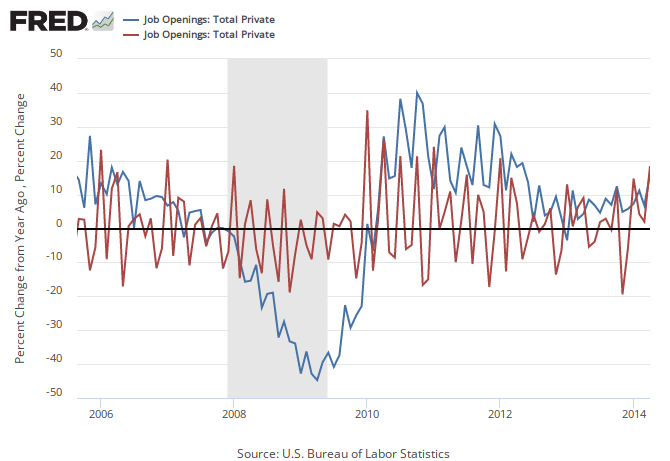

Unadjusted Private Jobs Openings from JOLTS – Year-over-Year (blue line) compared to Change from Last Month (red line)

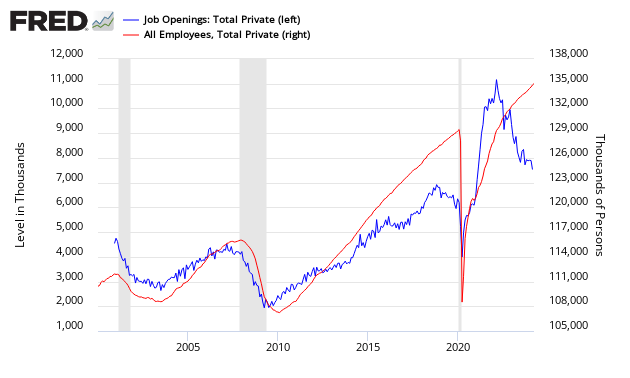

The relevance of JOLTS to future employment is obvious from the graphic below which shows JOLTS Job Openings leading or coincident to private non-farm employment. JOLTS job openings are a good predictor of jobs growth turning points.

Seasonally Adjusted Private Jobs Openings from JOLTS (blue line, left axis) compared to BLS Non-farm Private (red line, right axis)

The graph below uses year-over year growth comparisons of non-seasonally adjusted non-farm private BLS data versus JOLTS Job Openings – and then compare trend lines. JOLTS is showing a long term trend improvement – even with the decline this month.

Year-over-Year Change – Seasonally Jobs Openings from JOLTS (blue line, left axis) compared to Unadjusted BLS Non-farm Private (red line, right axis)

Leave A Comment