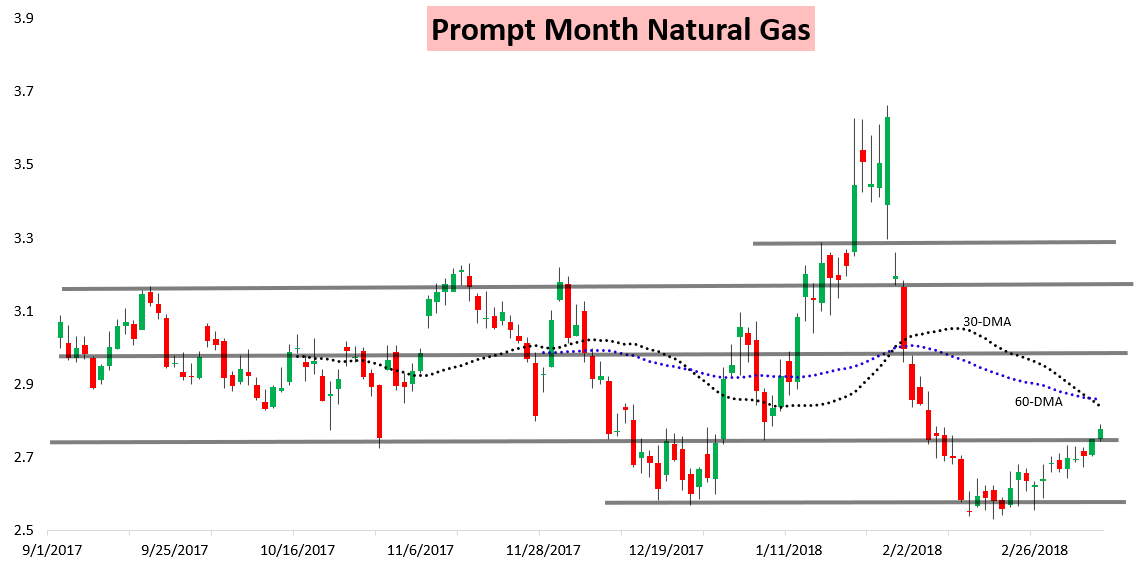

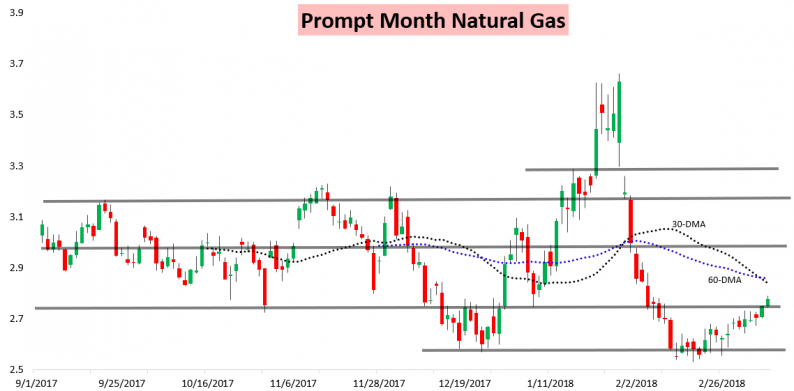

Natural gas prices continued their grind upwards Wednesday as late March kept trending colder, rallying another percent.

Through much of the day the prompt month March contract led, though it dipped a bit into the settle with the rest of the strip remaining firm.

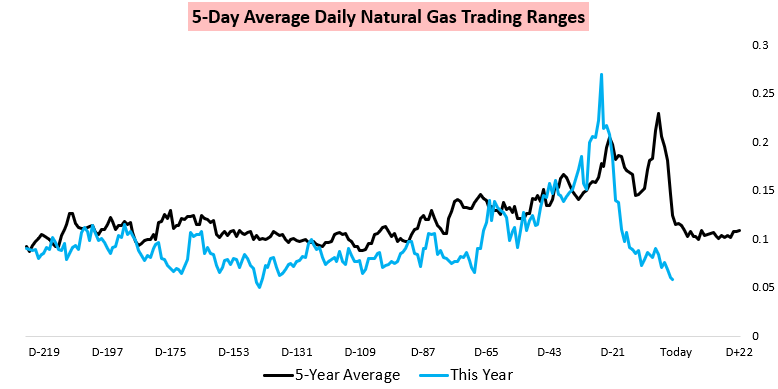

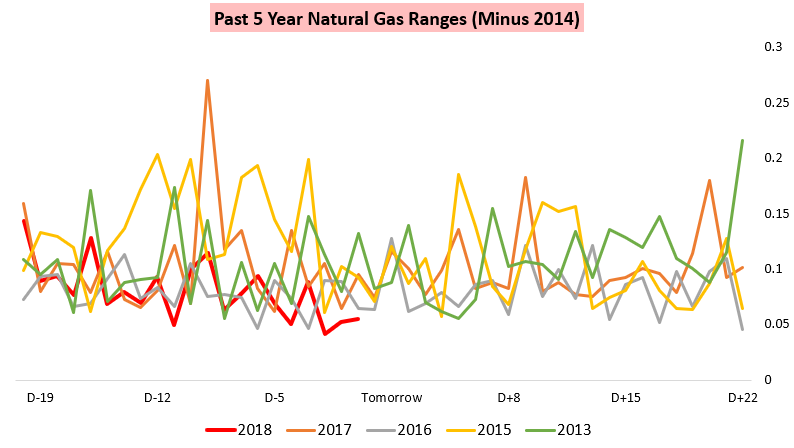

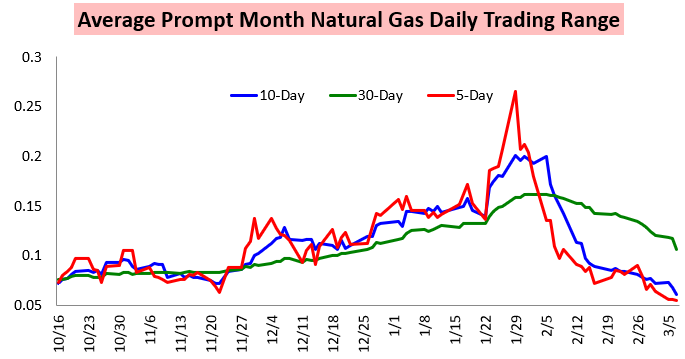

Yet even with back-to-back days of prices moving more than a percent, the daily ranges remain significantly below average levels.

Even in past years where prices were lower we saw larger daily trading ranges, as instead trading has recently been rather one-directional.

These trends come even as weather model guidance increases forward weather-driven demand expectations. Our afternoon GWDD forecast for clients bumped expectations up by around 10 GWDDs through the next 15 days, putting weather-driven demand solidly above seasonal averages for March.

As can be seen, American GEFS guidance trended significantly colder in its afternoon run for Days 8-14 in what was one of the larger mid-day model adjustments in awhile (image courtesy of the Penn State E-Wall).

Still, the steady grind higher in natural gas prices continues with the average daily trading range only ticking lower.

Tomorrow traders have the weekly natural gas inventory change print from the EIA to inject a bit more volatility into the market. Each week we provide a rapid release report immediately following the data release, and we release 4-week estimates of the data daily to help traders estimate gas flows in and out of storage and position accordingly. These are updated in tandem with our GWDD forecasts and fit in with our natural gas supply/demand modeling to determine current market balance, all of which make up our weather-driven natural gas sentiment.

Leave A Comment