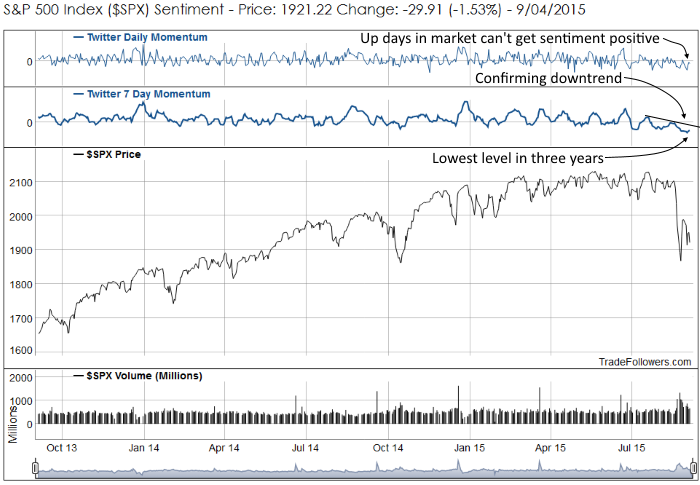

Not a lot has changed from last week. The damage done to sentiment for the S&P 500 Index (SPX) continues to plague market participants. The best that can be said is that traders and investors are taking a break to lick their wounds in an effort to recover…and the recovery isn’t going well. Rallies in the market still aren’t coming with positive daily momentum readings which is causing 7 day momentum to stay mired at the lowest level over the past three years. Very few people are buying as most now believe that a retest of the August lows is inevitable.

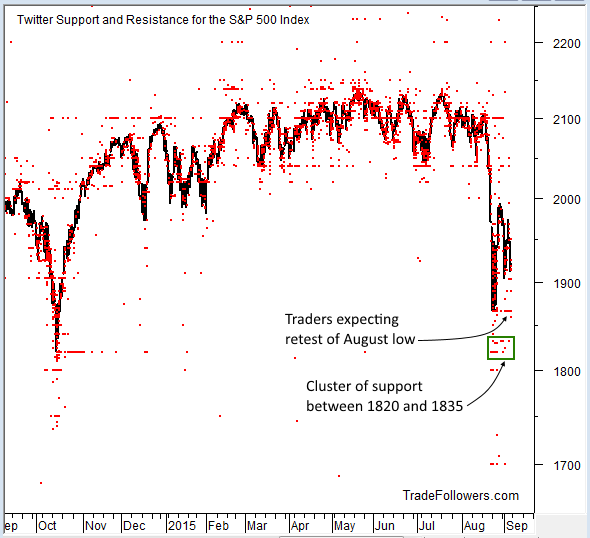

Another sign that a retest of the August lows is in our future comes from support and resistance levels gleaned from the Twitter stream. Most prices targets tweeted below the market are in the 1865 area where SPX last bottomed. Below that there is a cluster of support between 1820 and 1835. A break of SPX 1865 will like carry to 1835 or 1820 before buyers show up.

Breadth calculated between the number of bullish and bearish stocks on Twitter is ticking up slightly. Unfortunately, the rise comes while the number of bullish stocks is falling. Market participants are selling their leaders and buying beaten up stocks. This provides some support for a temporary floor, but isn’t constructive in the context of a longer term bull market. The behavior is more likely bearish in nature.

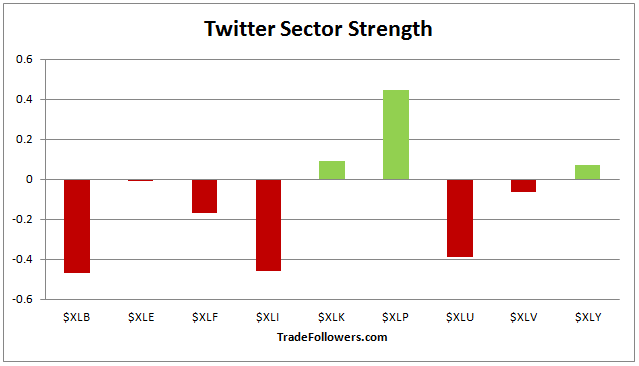

Sector sentiment was not very constructive this week. It had leading sectors with mostly negative readings while consumer staples, a defensive sector, showed the most positive sentiment.

Conclusion

It appears that traders on Twitter are expecting at least a retest of the August lows. Rallies aren’t inspiring confidence and investors are selling their leaders and looking for value in the beaten up stocks. If this action persists the likely direction of the market will be down over the long term.

Leave A Comment