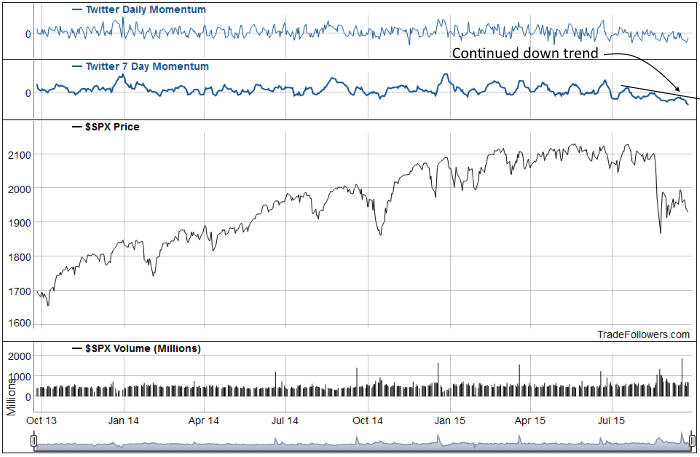

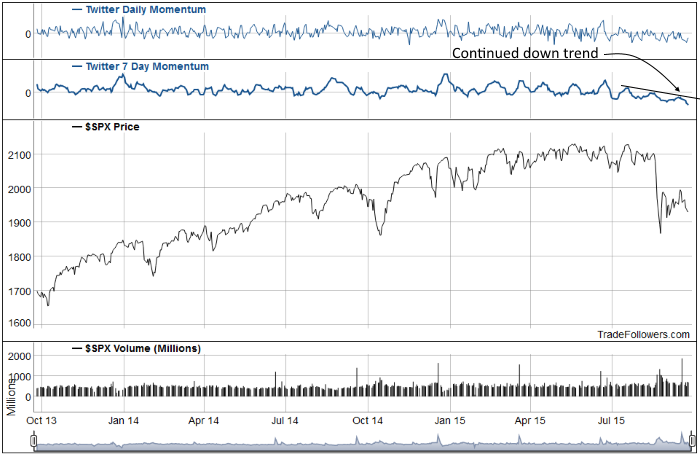

Last week sentiment was telling us that the market was going lower again. This week sentiment calculated from the Twitter stream for the S&P 500 Index (SPX) continues to decline. The rally out of the August low wasn’t accompanied by a large number positive sentiment reading. This indicates that market participants were selling into the rally rather than becoming bullish. Now that the market has turned back down, extreme bearish readings are showing up again. More people are looking down than up which will most likely result in a retest of the August low.

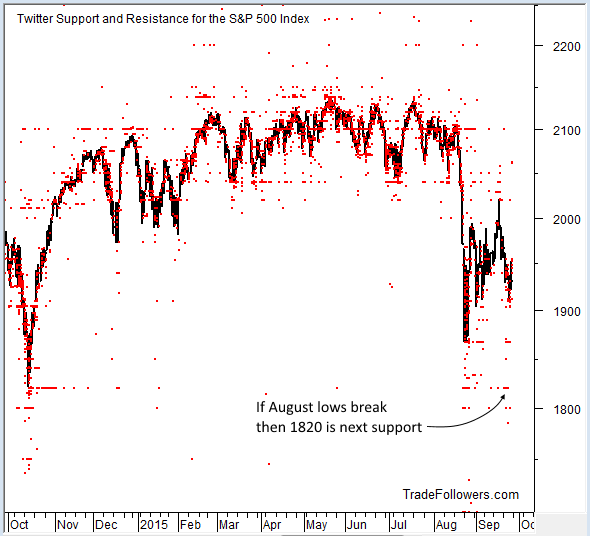

Looking at support and resistance levels gleaned from the Twitter stream for SPX shows 1820 as the first area of support if the August low near 1865 breaks. With sentiment so negative the odds favor a break to 1820 before we have a chance of a sustainable bounce.

Breadth calculated between bullish and bearish stocks on Twitter is showing an increase in the number of bearish stocks again. This suggests that value buying is stopping and traders are selling the stocks they picked up for an oversold bounce. If the number of bearish stocks overwhelms the bullish stocks it will indicate that the long term trend has changed to down.

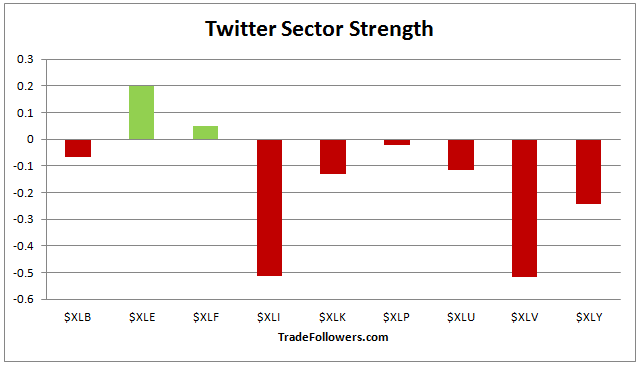

Sector sentiment is mostly negative which reflects the broad based damage that has occurred.

Conclusion

Everyone seems to be looking down. Until we start to see a positive divergence in price from 7 day momentum or a break of the down trend line the most likely direction for the market will be down.

Leave A Comment