(Photo Credit: Tinou Bao)

Over the next three weeks we will get a read on the health of the US consumer, as a slew of retailers begin to report. This week the focus will be on the department stores, with Macy’s, Kohl’s, Nordstrom and J.C. Penney scheduled to report and provide their outlook for the holiday shopping season.

The retail sector is full of haves and have-nots this quarter. Despite saving more due to lower gas prices, wages haven’t improved much, causing consumers to carefully consider how they allocate their discretionary income. The National Retail Federation has already warned us not to expect a great holiday season; retailers will have to offer deep discounts in order to compete. Add to that unseasonably warm weather in the Northeast and Midwest, leading to a build up of fall and winter inventory at many of the apparel names. The departments stores in particular have been losing out to specialty retailers for the past couple of years. Here’s what expectations look like for the third quarter:

Macy’s (M)

Consumer Discretionary – Multiline Retail | Reports November 11, before the open.

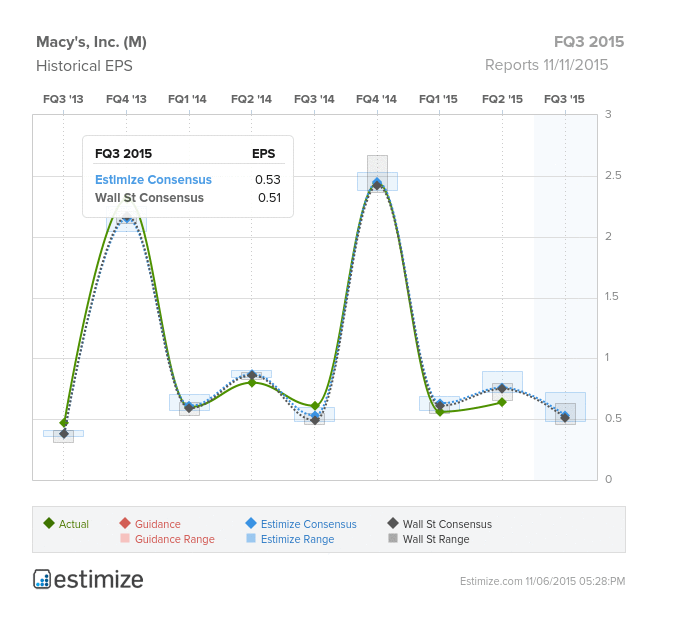

The Estimize consensus calls for EPS of $0.53, two cents higher than the Wall Street estimate. Revenues of $6.162B are just slightly above the Street’s expectation for $6.155B.

What to watch: This year has not been kind to Macy’s which has reported two negative quarters of profits and revenues. The company blamed those losses on the West Coast port strikes, lower spending by international tourists due to the strong dollar, and weakness in key segments such as jewelry. Heading into the holiday season the company is focusing on many growth initiatives to boost performance. The department store has been refining their M.O.M strategy, which stands for My Macy’s localization (catering to different types of customers based on location), Omnichannel integration (helping customers shop seamlessly on-line and in stores) and “Magic selling” (improved customer service initiative). The company is rapidly expanding it’s beauty business through its acquisition of Bluemercury earlier in the year, and is also considering opening “off-price” locations like those of competitors Saks and Nordstrom. Several partnerships are also in the works, including one with Best Buy to make consumer electronics available in stores, and a collaboration with online fashion tech startup, Nineteenth Amendment.

Leave A Comment