This year has brought a bumper crop of mergers & acquisitions already, and the trend continued in October. However, while the number of announcements grew, acquirers spent less on M&As in aggregate during the month compared to how much they spent in September.

M&A activity in the U.S. still rising

FactSet’s Mergers staff reports that M&A activity in the U.S. increased 1.8% in October month over month, reaching 1,078 deal announcements. Overall spending on those deals declined, however, as those making offers spent 3.1% on their deals in October compared to the month before. Here’s a look at how M&A activities have been shaping up by month over the last couple of years:

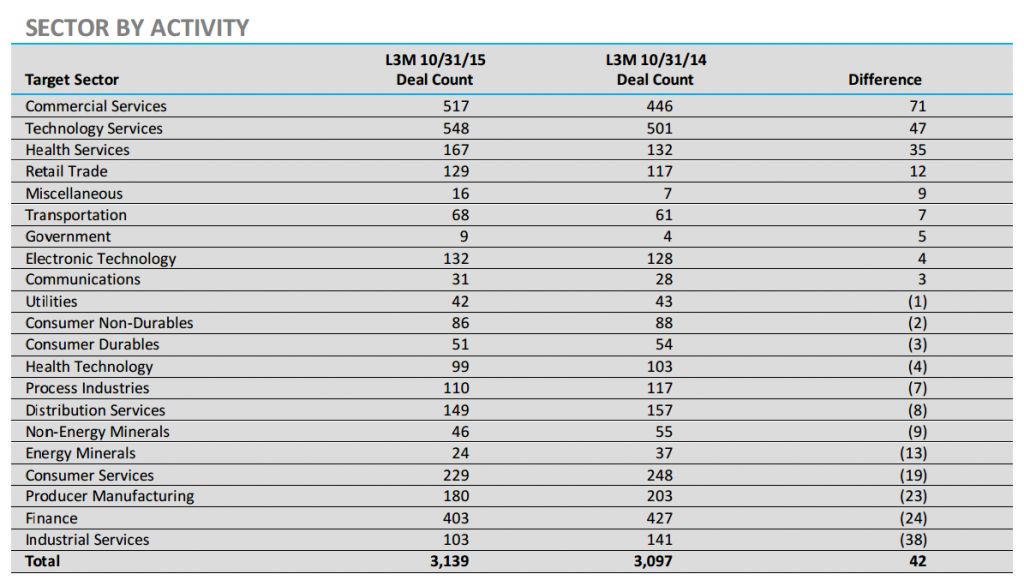

Commercial Services, Technology Services lead in M&A growth

The firm reports that based on year over year growth for the last three months, the Commercial Services and Technology Services witnessed the largest increases, with the former capturing 517 deals this year compared to 446 last year and the latter taking 548 deals compared to last year’s 501. Health Services was in a distant third place with 162 deals compared to 132 deals last year. According to FactSet Mergerstat, nine of the 21 tracked sectors saw year over year gains in M&As over the last three months.

The three sectors that have witnessed the biggest year over year volume declines over the last three months are Industrial Services, which fell from 141 to 103 this year, Finance, which fell to 403 from 427, and Producer manufacturing, which declined from 2013 to 180. Twelve of the tracked sectors saw year over year declines in M&A deal flow over the last three months adding up to a total decline of 151 deals.

Here’s how M&A activity is shaping up by sector:

Pfizer – Allergan leads in M&A deal size

FactSet reports that the largest deal announced in October was Pfizer’s (PFE) offer of $149.8 billion to buy Allergan (AGN). In a distant second place was the acquisition of EMC Corp. (EMC) by a group of private buyers led by Dell Founder Michael Dell, MSD Partners, and Silver Lake Management in a deal worth $64.3 billion.

Leave A Comment