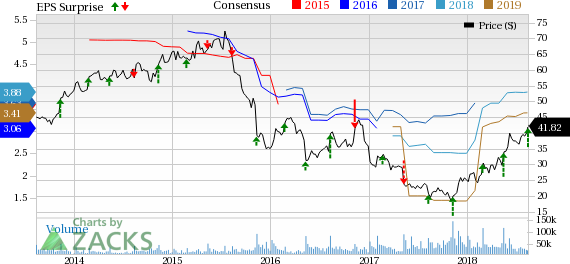

Macy’s, Inc. (M – Free Report) delivered the fifth straight quarter of positive earnings surprise, when it reported second-quarter fiscal 2018 results. However, total sales fell short of the consensus mark after a beat in the preceding quarter. With this, the company delivered negative sales surprise in three of the last four quarters.

The company highlighted that impressive performance across Macy’s, Bloomingdale’s and Bluemercury brands boosted results. Management hinted that its Growth50 stores initiative is aiding growth at its brick-and-mortar stores. This along with robust e-commerce and mobile-commerce bode well for the company.

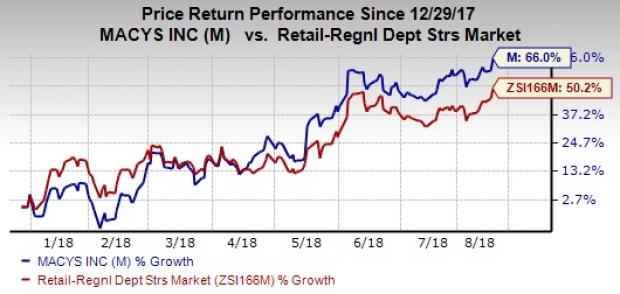

Confidence in its strategic initiatives, solid execution and a robust consumer spending environment has prompted this U.S. department store chain to lift the sales and earnings view for fiscal 2018. However, the market punished the stock probably on the soft sales performance, sending shares down 5.5% during pre-market trading hours. Nonetheless, this Zacks Rank #2 (Buy) stock has rallied 66% year to date, compared with the industry’s gain of 50.2%.

Let’s Delve Deep

Macy’s posted adjusted earnings of 70 cents a share, excluding impairment and other costs, compared with 46 cents reported in the year-ago period. Excluding gain from sales of assets, earnings came in at 59 cents, up 59.5% from 37 cents delivered in the prior-year quarter. We note that the bottom line comfortably surpassed the Zacks Consensus Estimate of 49 cents. Earnings gained from solid performance across stores as well as persistent digital growth.

Macy’s, Inc. Price, Consensus and EPS Surprise

This Cincinnati, OH-based company generated net sales of $5,572 million that lagged the Zacks Consensus Estimate of $5,619 million and dipped 1.1% year over year.

Comparable sales (comps) on an owned plus licensed basis jumped 0.5%, while on an owned basis, comps were flat with the prior-year quarter. The shift in the spring Friends & Family promotion due to the 53-week calendar in fiscal 2017, mainly impacted comps in the fiscal second quarter. Adjusting for this shift, comps on an owned plus licensed basis increased 2.9% in the fiscal second quarter. This marked the third straight quarter of comps growth for the company. Strategic investments across stores, technology and merchandising are aiding comparable sales growth.

Leave A Comment