Today was yesterday’s alternative ending…

Video length: 00:01:12

Only Nasdaq remains marginally green on the year…

Today’s fun and games started with comments from Wilbur Ross on “emergency” curbs on Chinese investment but then a series of headlines on megatech – NVDA self-driving car suspension, TSLA NTSB probe, FB hearings and more headlines, and GOOGL and TWTR being dragged into the furore. All in all – a bloodbath!

What goes up (on low volume) collapses on heavy volume… (Nasdaq – green, was worst; The Dow – blue, managed to hold some gains)…

Cash markets saw Nasdaq and Small Caps erase all of yesterday’s gains…

Equity market momentum was massacred today…

The S&P 500 failed to get back to its 100DMA (blue) and tumbled back towards its 200DMA (red)…

The Dow is back below its Fib 38.2 Retrace level…

VIX spiked back above 23…

FANGMAN Stocks were a total bloodbath…

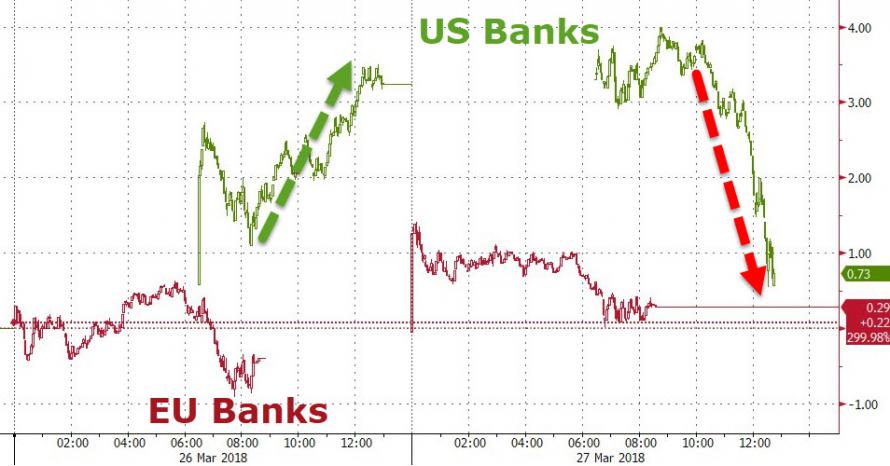

US bank stocks collapsed back to reality today…

Fading yesterday’s outperformance of European banks…

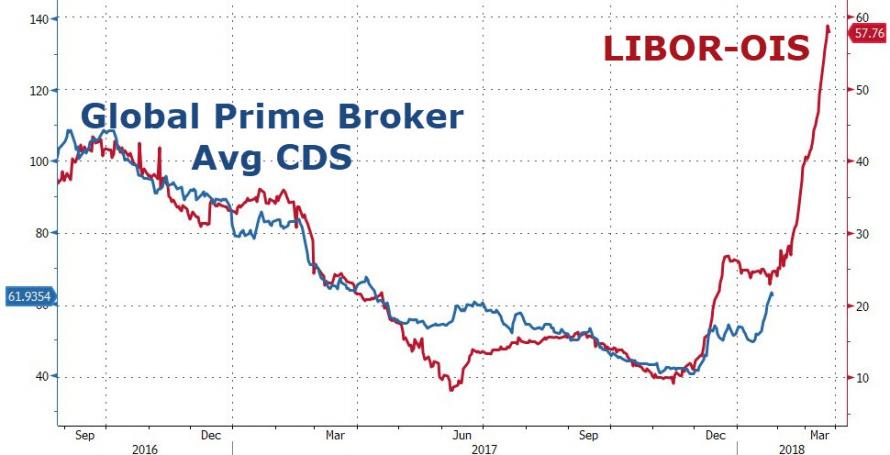

Credit stress continues to build…

HY and IG smashed wider…

Bonds led stocks…

Bond yields tumbled today…

Real and BEs collapsed…

10Y Yields broke their 24-day streak of closing with a 2.8x% handle… to the downside, closing at 2.78% – lowest close since Feb 5th…

And the yield curve collapsed to fresh 11 year lows…

Leave A Comment