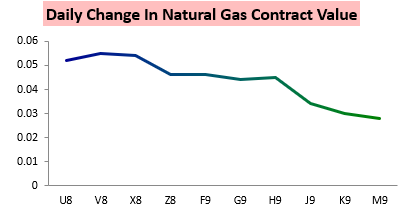

The September natural gas contract rallied just less than 2% today as traders braced for the next weekly EIA print.

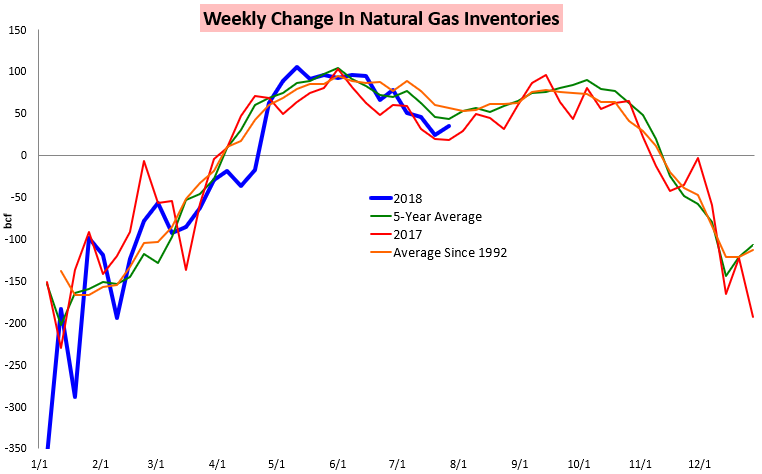

This comes following three EIA prints that were solidly below the 5-year average and missed significantly bullish to most market expectations.

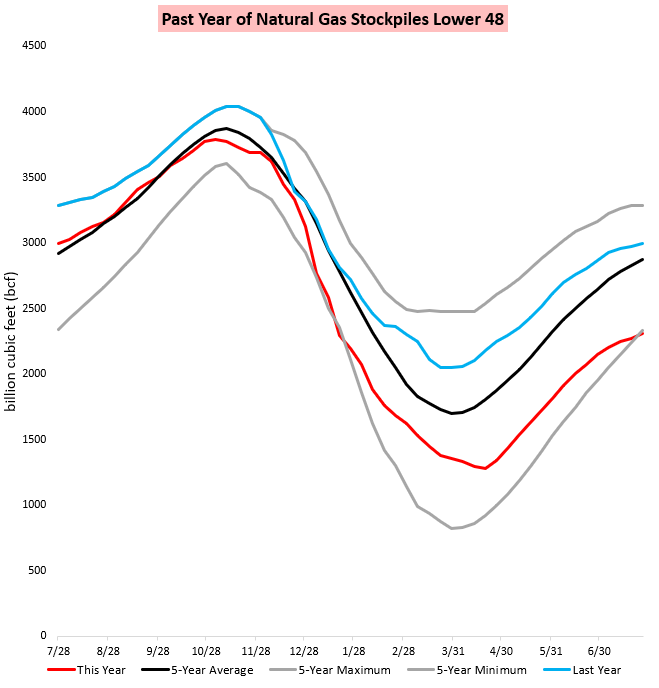

Accordingly, national stockpiles dipped below the 5-year range and the deficit from the 5-year average grew significantly.

Most estimates have tomorrow’s print slightly below the 5-year average yet again. This growing storage deficit seems to have played a significant role in rallying natural gas prices, with the entire strip seeing sizable gains again today.

Meanwhile, weather forecasts remained relatively stable this week. In our Morning Update we warned clients to expect cooler risks in afternoon model guidance.

Sure enough, those trends arrived, with afternoon European guidance cooling off and on the day we actually saw the U/V spread tick lower even as the strip rallied.

Still, it is clear that tomorrow’s EIA print is a key catalyst for this market, and should play a major role in determining price action into the end of the week. In our Afternoon Update we broke down our expectations for the print as well as how we saw it likely impacting natural gas prices and how weather models were likely to trend into the end of the week.

Leave A Comment