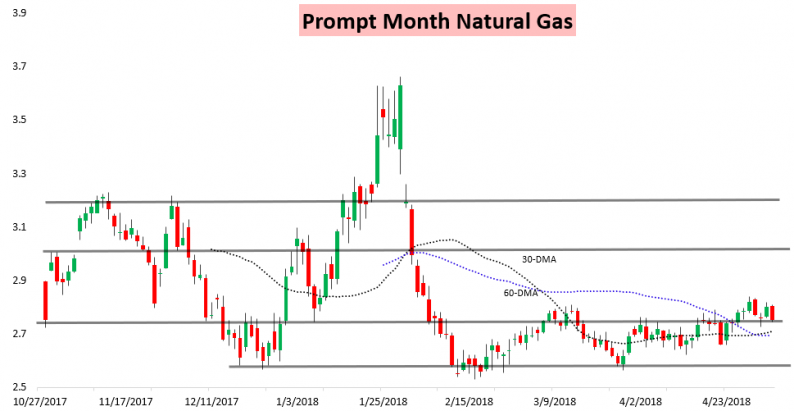

Just like that, June natural gas prices were right back down today, losing all their gains from yesterday as traders looked for a loosening supply/demand balance into May.

After the prompt month contract led the way higher yesterday it led the way lower today, with quite a bit of weakness into the fall as well.

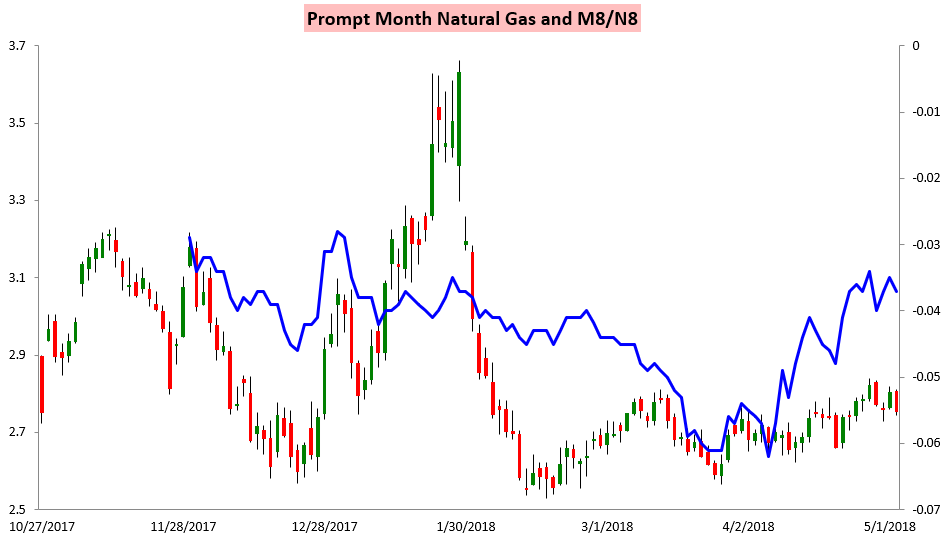

The June/July M/N natural gas spread thus did not fall back nearly as much as flat price, as it remains more narrow than the last time prices dipped down to around these levels.

This came as weather forecasts continue to be rather unimpressive, with our Morning Update continuing to forecast GWDDs a bit below average through the next 15 days which would struggle to support prices.

Today’s selling was certainly not a surprise, with our Early Morning Text Message Alert for clients warning of downside on the day.

Our Afternoon Update yesterday similarly alerted that any rallies were shorting opportunities, as yesterday’s bump proved to be.

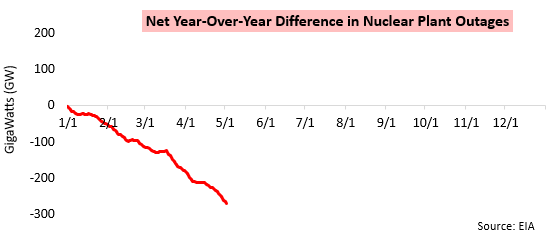

This comes as year-over-year nuclear outages continue to be incredibly disappointing, with far fewer outages resulting in less natural gas burning than we saw last year.

As we mentioned yesterday, after three straight bullish EIA prints all eyes will be on tomorrow’s print to see if we can sustain the tighter-than-expected narrative that has propped up the front of the natural gas strip. In our Afternoon Update we broke down our expectations around the print tomorrow and how we see natural gas prices likely to respond, with our Morning Update tomorrow providing our final forecast and our EIA Rapid Release coming out immediately following the print with our latest analysis. To begin receiving all this research, and see how we have helped traders accurately navigate the natural gas market through this shoulder season, try out a 10-day free trial here.

Leave A Comment