Nvidia (NVDA) has benefited tremendously from the growing demand for GPUs in the gaming industry over the past several years. In addition to this, computing is becoming increasingly more visual in all kinds of areas, which is providing a strong tailwind for GPUs.

Management has played its cards well, positioning the company for growth in areas with massive potential for expansion in the years ahead. Artificial intelligence and deep learning applications that use the company’s graphics chips are particularly promising, and Nvidia is betting on autonomous vehicles with its Drive PX self-driving platform.

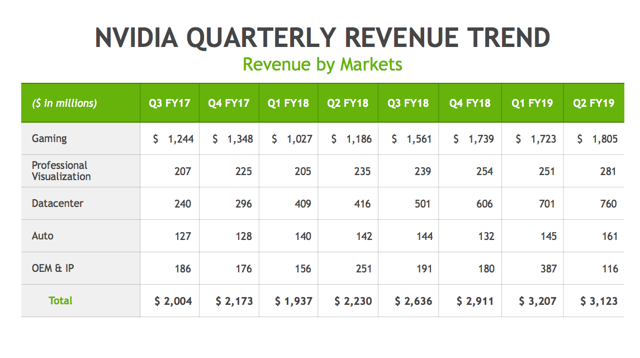

Source: Nvidia.

Financial performance is quite remarkable. The company has delivered booming revenue growth over the past five years, while profit margins have enlarged. Rapidly growing sales in combination with expanding profit margins have provided a double boost to earnings per share over time.

NVDA Revenue (TTM) data by YCharts

The following chart compares key financial performance metrics for Nvidia versus the average company in the industry, and Nvidia is substantially above-average across the board. Revenue growth, net income growth, operating profit margin, net profit margin, return on assets (ROA), and return on equity (ROE) are all pointing in the same direction.

The most recent earnings report from Nvidia confirms that the business keeps growing at full-speed as of the quarter ended on July 29, 2018. Total revenue amounted to $3.12 billion during the quarter, growing by 40% versus the same quarter in the prior year. Non-GAAP earnings per diluted share were $1.94, up by 92% percent from $1.01 a year earlier.

Looking at the company’s main growth engines, performance looks quite solid across the board, and this is a major positive in terms of evaluating Nvidia’s ability to sustain performance going forward.

Source: Nvidia

The gaming industry looks as strong as ever thanks to vigorous trends such as booming demand for eSports and the unprecedented success of Fortnite and PUBG, which has popularized the Battle Royale genre and expanded the gaming market. This segment accounts for 58% of the company’s revenue, and the year-over-year growth rate in the gaming business reached 52% last quarter.

Revenue in the datacenter segment reached $760 million during the period, with year-over-year revenue growth accelerating to 83%. This performance was driven by expanding demand as internet services are increasingly leveraging AI.

Scale advantages and unique intellectual properties provide key sources of competitive strength for Nvidia. Besides, the company is building strategic alliances with players such as Amazon (AMZN), Baidu (BIDU), and Facebook (FB) in AI. Nvidia is also partnering with industry leaders such as IBM (IBM), Microsoft (MSFT) and SAP (SAP) in order to bring AI to the enterprise market.

Leave A Comment