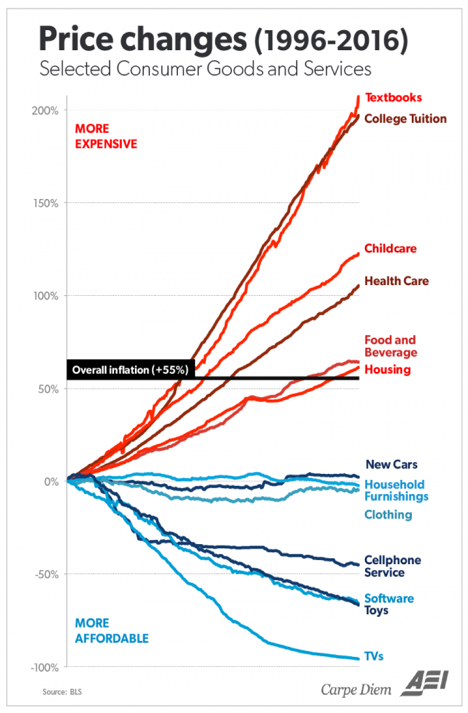

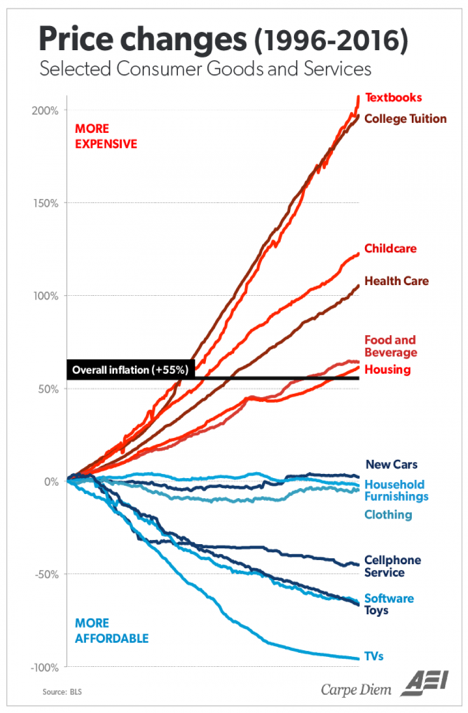

There are several key factors that have contributed to the financial fragility of the masses and our economy today. First, is that over the past 30 years, globalization and technology have helped to reduce the number of middle-class jobs available domestically. Fewer jobs and superfluous workers have led to stagnate incomes for most. At the same time, living expenses for critical services that are domestically-produced like education, medical services, child-care, housing and fresh food have all strongly outpaced income gains.

Today a middle-class lifestyle in America (ie., comfortable housing, transportation, food, health care and one family vacation a year), is estimated to require about 130k of annual household income for a family of 4. The median US household income, however–at 50k a year–is less than half the funds needed. In Canada, estimates of ‘middle class’ expenses vary in the range of 50-100k a year (see: Just who are middle-class). According to the latest 2014 Statscan census, the median Canadian household income was $78,870.

To plug spending deficits over the past 3 decades, families have increasingly added debt.American households now owe a record $12.7 trillion and Canadians $2 trillion, as of Q1 2017.Not only does servicing this debt further diminish disposable cash flow, but it also keeps people from building up net savings from their income.

Not surprisingly then, most households have insufficient retirement savings and about half say that they have no emergency savings to draw on and would have trouble coming up with $2k if needed within the next 30 days.

This leads to the last key contributor in this problem. Being over-indebted, under-saved and cash flow-deficient renders the masses vulnerable to a financial industry that has queered rules and policies in its favor while extracting hundreds of billions for itself –selling debt, transactions and products (under the guise of ‘advice’)–to an increasingly desperate and largely financially illiterate public.

Leave A Comment