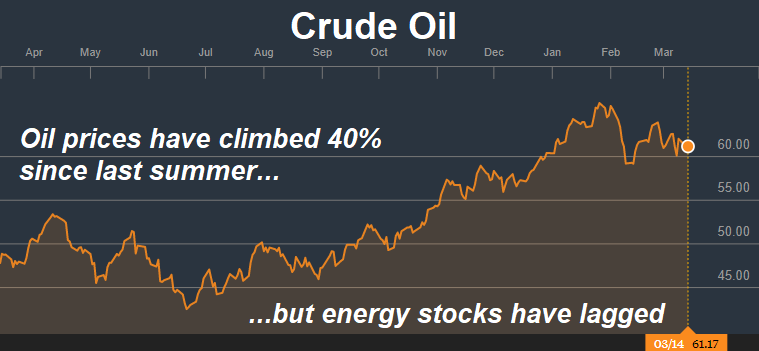

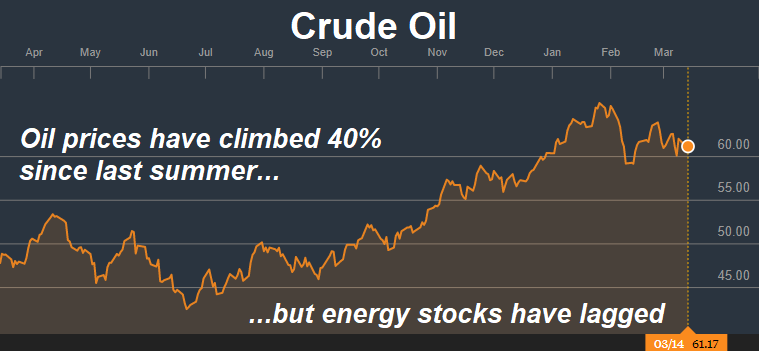

While oil prices trade above $60 a barrel, up over 40% from their June 2017 lows, energy stocks have languished. Why the disconnect and will this persist?

This time on Financial Sense Newshour, we spoke with Dan Steffens from Energy Prospectus Group to get his outlook on the energy sector, US shale production, and concerns over peak oil demand.

Source: Bloomberg

US Shale Production Fears Overhyped

With both the EIA and IEA projecting for the US to produce more oil than Saudi Arabia next year, some are concerned that this will set a cap on oil prices and hamper gains for energy-producing companies as a whole.

This isn’t as big an issue as some fear, Steffens said, because demand for oil is going up by 1.5 million barrels a day per year, and he expects it to rise still higher from there.

Also, it’s important to keep in mind that shale oil production tends to drop off precipitously. Horizontal wells will decline at a 30 to 40 percent rate per year, Steffens noted.

“I think we’re going to see an increase in demand from the first quarter to the second quarter of about 2 million barrels a day as we come out of the winter driving season,” Steffens said. “I’ve been watching EIA for a long time. … The math just doesn’t work. Sooner or later, you just can’t drill enough new wells to make up for the decline in older wells. I think that’s going to come into play in about a year or so.”

Further Catalysts for Energy Stocks

“The global economy’s growing,” he said. “We’re in an economy that is very dependent on a steady supply of this stuff, and we’re below the 5-year average on days of supply.”

There are also price catalysts to consider. While Steffens isn’t as worried about shale keeping a lid on prices, some are concerned about OPEC’s production cutback agreement expiring this year. This isn’t really a problem, however.

Leave A Comment