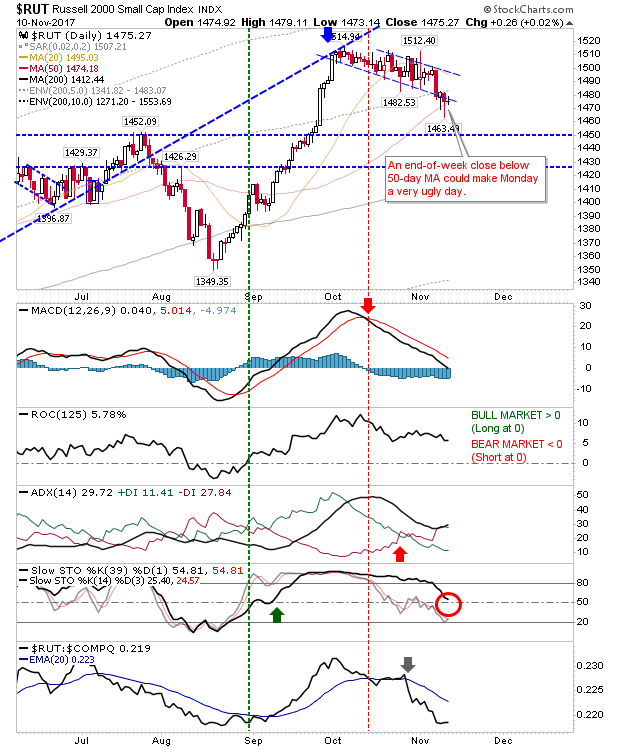

It wasn’t a particularly exciting Friday but there were some points-of-action of interest. I had tweeted about the weakness in the Russell 2000 but there wasn’t much satisfaction for either side. The Russell 2000 finished with a narrow doji at the 50-day MA. As it failed to close below the 50-day MA bulls will be satisfied with a successful defense of the 50-day MA but the narrow intraday range offers a bigger swing trade off a break of the high/lows from Friday. There is still a chance a break below the 50-day MA will kickstart an acceleration towards the 200-day MA and this still looks like the preferred outcome. Any move back inside the ‘bull flag’ will open up for a ‘bear trap’ and a likely break of 1,500 – a move above 1,480 will open up a long trade opportunity.

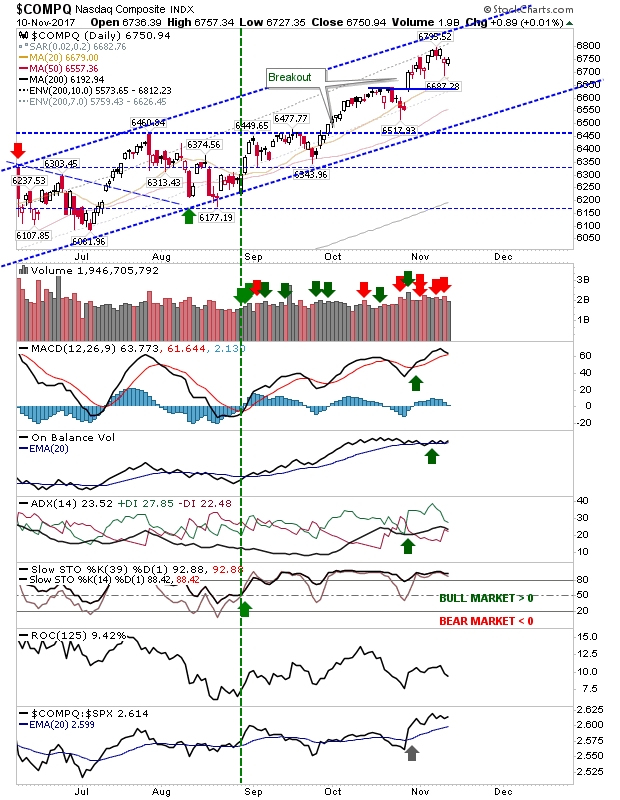

Tech indices held on to Thursday’s recovery and then managed to post a small gain (or at least a higher open). The Nasdaq is holding to its rising channel which keeps the broader bullish picture intact.

The S&P stuck to upper channel resistance (now support). Volume was down so no real switch to selling/profit taking. If the Russell 2000 can post a bounce then I would look for a fresh run to new all-time highs in the S&P; looks like traders need Small Cap leadership at this time.

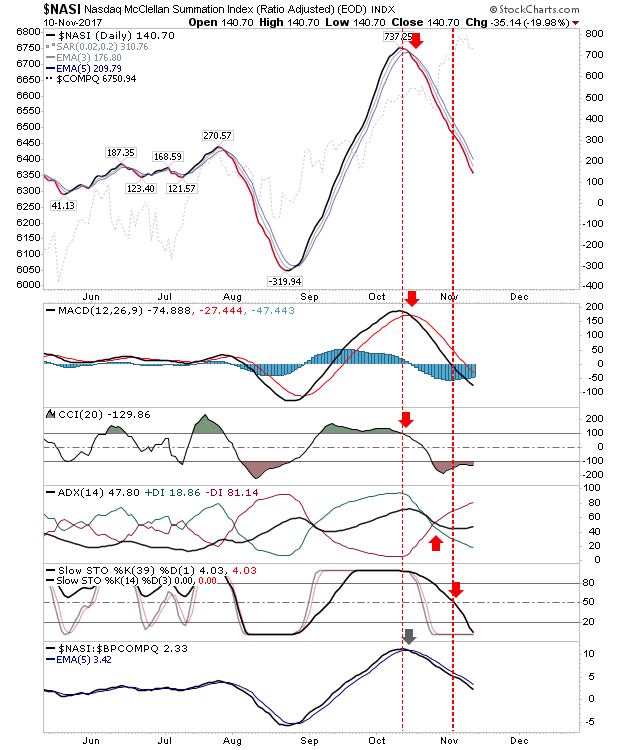

The Nasdaq Summation Index doesn’t look like it’s suggesting we are at a bottom yet; significant market lows for the Nasdaq require an upturn (and cross of 5-day EMA) with the index below -500. This is clearly not the case yet.

The Percentage of the Nasdaq Stocks above the 50-day MA are also in a scrappy bearish decline; nothing suggesting a swing low yet.

Bullish Percents are attempting a low but well away from oversold levels; for this index I would want to see sub-30s for long term buys. At best, it’s a short term buying opportunity if there is a close above the 5-day EMA.

Leave A Comment