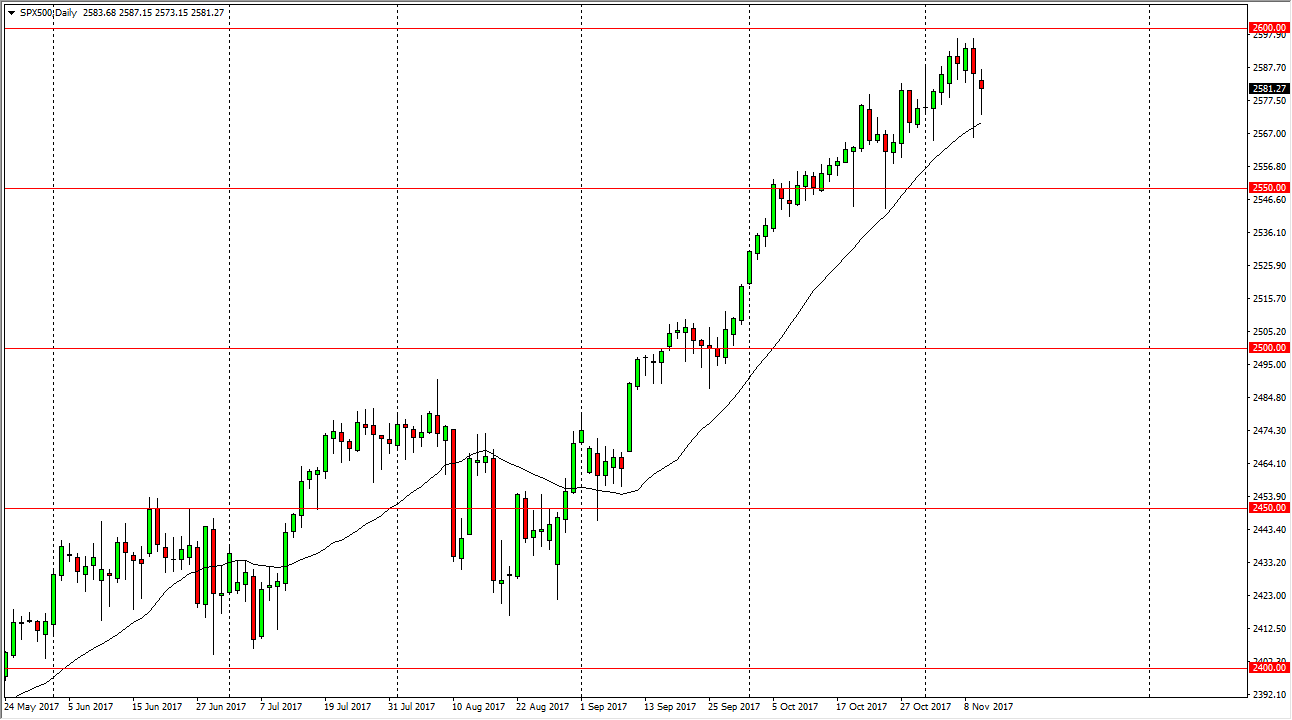

S&P 500

The S&P 500 initially fell during the day on Friday but found enough support underneath to turn around and form a hammer again. Ultimately, this is a market that has been finding buyers every time we pull back, but I think this can only go on for so long. At this point, it’s difficult to handle this market to the upside without getting some type of pullback. That pullback should offer value that is so desperately needed, and I would prefer to see a move towards the 2550 handle underneath. If we break down below there, the market should then go to the 2500 level. Alternately, if we break above the 2600 level it looks as if we would continue to go much higher, but it is very likely that it would become even dangerous to go long at that point as we would become even more overextended.

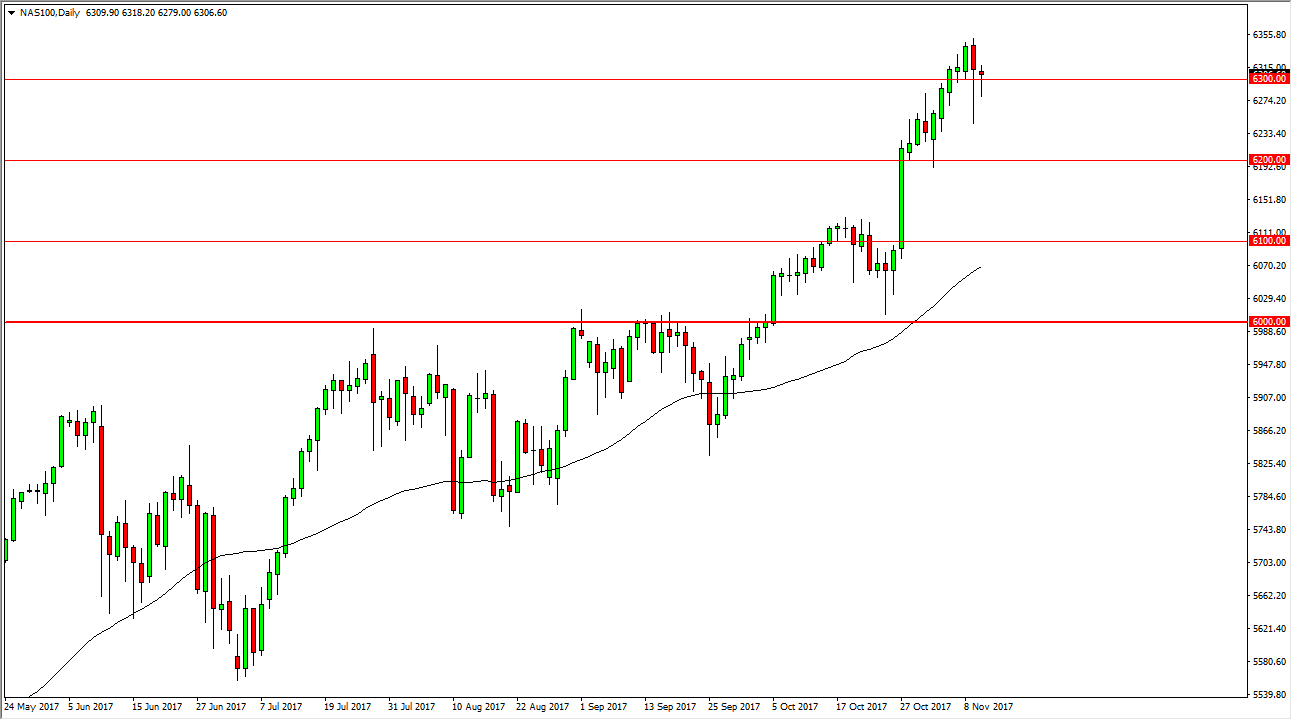

Nasdaq 100

The Nasdaq 100 fell initially during the day on Friday but turned around to rally above the 6300 level again. I think that every time we pull back, algorithmic trading comes back into play, but I think the market looks a bit overbought at this point, and I think we desperately need to see some type a pullback to pick up the value that we need. The 6200-level underneath would be an excellent place to start finding buying opportunities, and I believe that the 6000-level underneath should be the “floor” in the market, as it was so resistive. I do like this market longer term, but I think that much like the S&P 500, we’ve got far ahead of ourselves. What also concerns me is that European indices look very soft, and those can often have a knock-on effect in the United States.

Leave A Comment