Sectors as a whole remain bullish, despite recent market pullback.

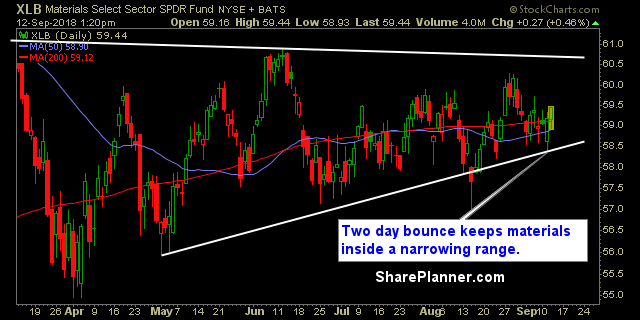

The two sectors that I like the least are the financials and the materials. Both of them look problematic, and the financials are showing more weakness today, despite already being oversold.

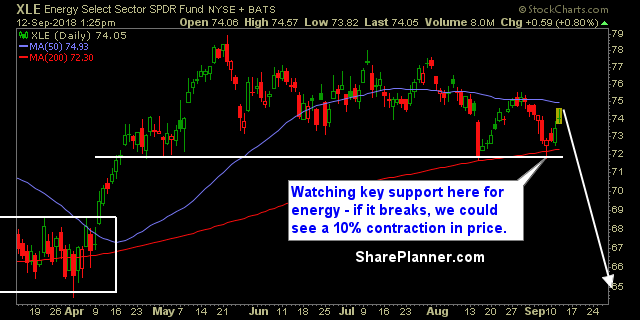

Now, I find the energy sector incredibly interesting, not so much because I am tempted to gobble up the energy stocks, but because, there is a clear topping pattern at play here, but it manages to save the bulls from any kind of confirmation each time when it is staring over the edge of the cliff. That is exactly what we have seen over the last two days as well. So far it is holding, but I’m not sure it will last.

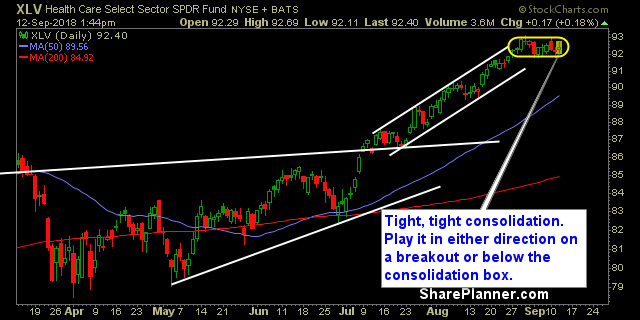

Finally there are a few sectors consolidating and waiting for its next move higher – so if you are looking to play those sectors below, then be patient and let confirmations play out first before front running any potential moves higher or lower.

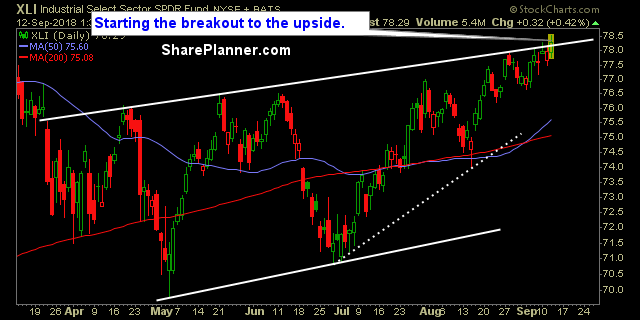

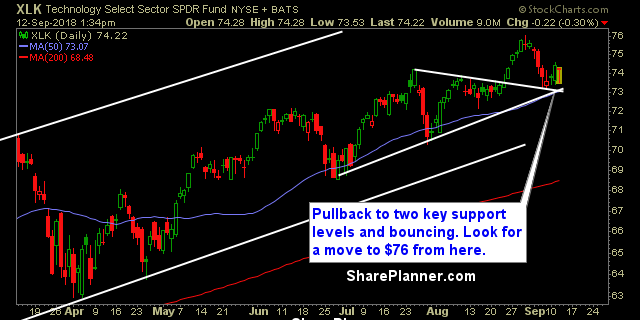

As for the top three right now, Technology could have been included in the top three, and remains a solid chart, however, the strength in industrials lately, along with healthcare still trading at their highs, and a stronger bounce in discretionary, kept tech out.

Here’s what I see as the top 3 sectors right now:

The 3 worse sectors are:

Financials, even though they are in the bottom three, isn’t all that bad, it simply just isn’t where the others are that this juncture.

Let’s review the sectors:

Basic Materials (XLB)

Energy (XLE)

Financials (XLF)

Industrials (XLI)

Technology (XLK)

Consumer Staples (XLP)

Utilities (XLU)

Health Care (XLV)

Consumer Disretionary (XLY)

Leave A Comment