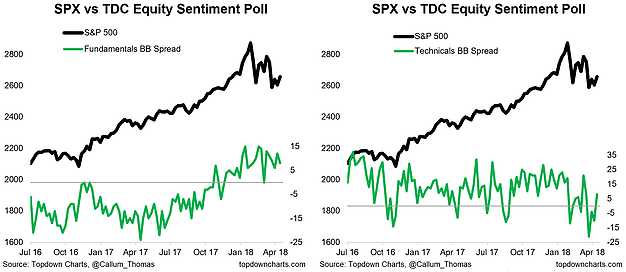

The latest results from the weekly surveys on Twitter showed a slight rebound in technicals sentiment, with the all important fundamentals sentiment still holding up well – at least for equities. This lines up with our optimistic view on the fundamentals and the data pulse which for now is still holding up well. In contrast to equities, bond market sentiment has seen a notable pullback from extreme bearishness, and ironically this could be just the thing that is required to set up the market for another push higher in bond yields. With markets in flux, it pays to stay on top of investor sentiment, so check out the charts below and follow us for updates.

The key conclusions on equity and bond market sentiment are:

1. Equity Fundamentals vs Technicals: The latest weekly survey on Twitter showed a solid rebound in “technicals” sentiment, as investors apparently reassess the risks of a bear market. Meanwhile fundamentals sentiment has held up fairly steady; not undergoing the same swings as we’ve seen in technicals sentiment. It speaks to the thesis that this is largely a technical/sentiment driven correction with fundamentals little changed.

2. Bonds vs Equities fundamental sentiment: However there are some mixed signals on the fundamentals sentiment as we’ve seen a big turnaround or correction in bond market sentiment on the fundamentals outlook vs equity market sentiment. The gap between these two is also a concern, because if equity fundamental sentiment starts to ‘catch-down’ to bonds it would mark a turning point and a shift to a more bearish outlook.

Leave A Comment