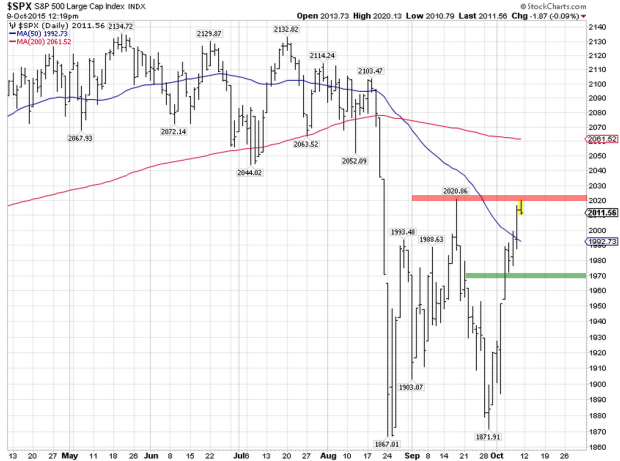

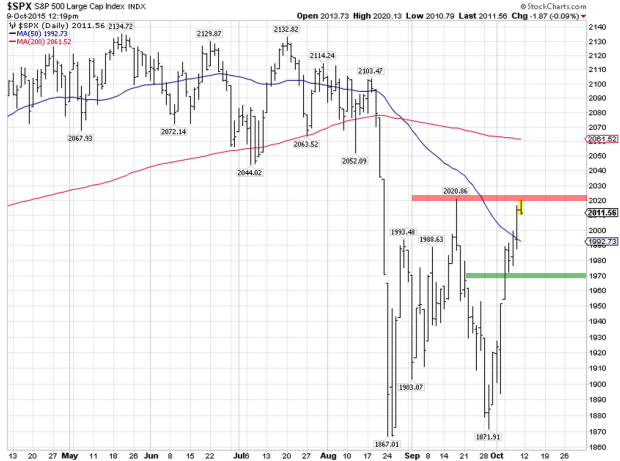

It’s been an impressive and amazing rally during these last five trading days. The market paused briefly at resistance in the 1990 area on the S&P 500, but has been very resilient. It appears the relentless bid is back in force.

Short term resistance was hit today as the S&P 500 briefly traded above its prior swing high at 2020. If this holds as resistance I would expect a retrace back down in the vicinity of 1970. At this point I don’t see any reason to expect much than 30 – 50 point pullback. However all four major averages remain below their 200 day moving averages, so there is still some technical damage that needs to be repaired.

Earnings season really kicks off next week with many of the big financial companies due to report. The bar is set very low for the quarter (projection of -5.1% earnings for Q3), so it’s possible for an increase in upside surprises due to the low sentiment.

Leave A Comment