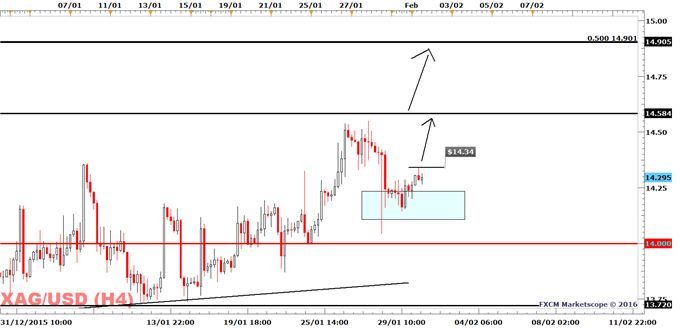

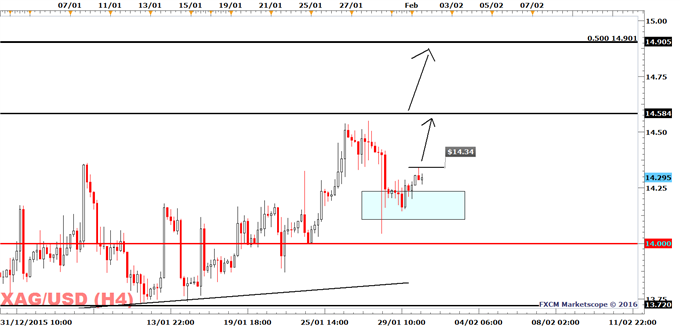

Silver prices did indeed bottom out as expected on Friday and yet these gains are not strong enough to warrant a rise in the trend-defining level.

Instead I stick to the January 22 low of $14 as the trend-defining level and see the trend as bullish above this mark. The next resistance level and target for bullish traders is the December 7 high of $14.58, a target silver should be able to reach so long as the correlation to the price of gold holds up.

According to gold prices, silver should be trading at $14.93 on gold remaining at or above $1123.

The bullish trend will most likely accelerate on a break to break today’s high of $14.34. The trend will turn bearish on a break to $14.00

Key Reports On Tap

A soft ISM reading may boost silver via a lower demand for the dollar (recession fears), while a stronger than expected PCE reading may soften silver as the demand for the Dollar increases (allows the Fed to proceed with its intended rate hikes).

While it is hard to know exactly how this will affect silver in the short-term, if the U.S. economy firms up and the Fed is allowed to hike rates in the months ahead, then I would expect silver to resume its long-term bearish trend. However, given the current price action and macro fundamentals, it’s too early to consider such an option at this stage.

Silver Prices | FXCM: XAG/USD

Leave A Comment