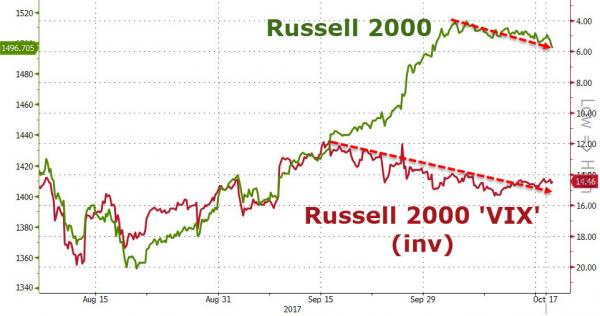

For the last month we have been noting a dramatic divergence between Small Cap stock prices and their implied risk…

We can only remember one such lengthy decoupling in recent history, and that did not end well…

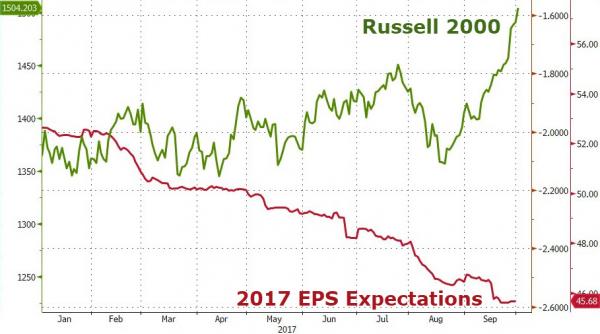

And of course this is all occurring as Small Cap earnings expectations plunge…

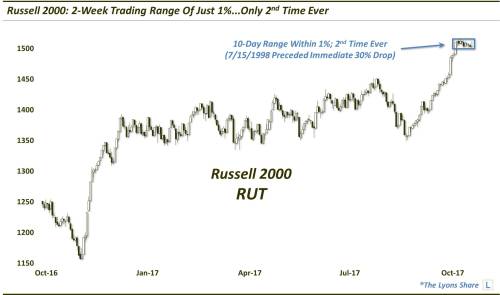

But now, as Dana Lyons’ Tumblr details, there has only been one trading range in the history of the Russell 2000 tighter than the current one – and it immediately preceded a crash.

As U.S. large-cap stocks continue to make new highs seemingly every day, the small-caps are doing something remarkable. Or, more accurately, it is what they aren’t doing that is remarkable. They aren’t moving at all – almost literally. In the past 2 weeks, the Russell 2000 Small-Cap Index (RUT) has amazingly traded within a range of just 1% (actually 1.01%…but close enough). This is just the 2nd time in its history (along with July 15, 1998) that it has traded for 10 straight days within an overall range of just 1%.

What, if anything, can we reasonably expect from the RUT following the culmination of this historic lack of movement? Well, tight ranges like this are often a precursor to a spike in volatility, at least in the near-term, as the range break releases the considerable coiled-up potential energy. But which way will it break – up or down?

Unfortunately, we don’t have a crystal ball. Both outcomes are plausible and explainable (often after the fact in the case of the latter). These tight ranges can constitute a continuation pattern in which prices digest the prior move before “continuing” in that same direction, e.g., up, in this case. However, the lack of movement within these tight ranges can also signify indecision – and can precede direction changes.

The July 1998 event, which, at 0.99%, is the only 2-week range in the RUT’s history tighter than the current one, occurred on the heels of a bounce as well. That event would mark a direction change – and immediately precede a 3-month crash of nearly 35%.

Leave A Comment