Incredibly enough, last week’s gain was the biggest weekly gain of the year. The S&P 500 (SPX) (SPY) gained 3.22% last week, and though it was mostly just fortunate timing that allowed for the big week-to-week move, the momentum is impressive nonetheless.

The question is, can it last? Answer: Maybe. The rally knocked over some fairly important resistance levels, though a few more remain. Also, the advent of Q3’s earnings season could either work for the market or against it.

Either way, the rest of October should be plenty exciting.

We’ll take a look at where stocks are and where they’re likely going right after a look at last week’s economic news and a preview of this week’s economic reports.

Economic Data

Last week was relatively slow in terms of economic news. In fact, the only item of real interest was the release of the minutes from last month’s FOMC meeting, and even that didn’t tell us anything we didn’t already essentially know. That is, the Fed is concerned about the slow-down in the global economy crimping the already-fragile state of the United States’ economic growth.

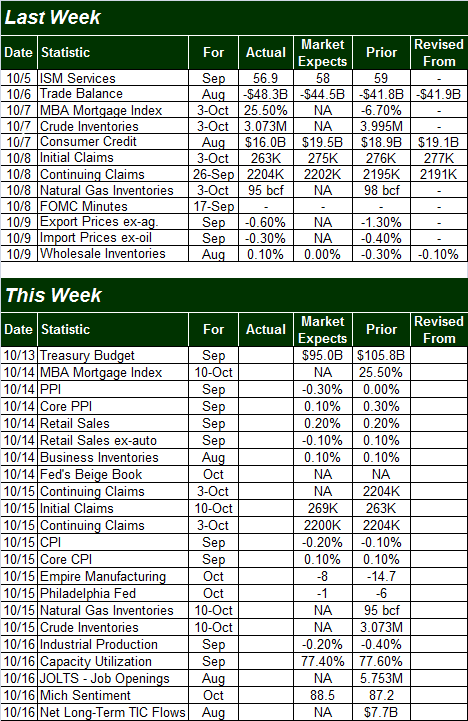

Economic Calendar

Source: Briefing.com

This week is going to be considerably busier, even though the party doesn’t start until Wednesday with last month’s producer price inflation data, which serves as something of a preview to Thursday’s consumer inflation data.

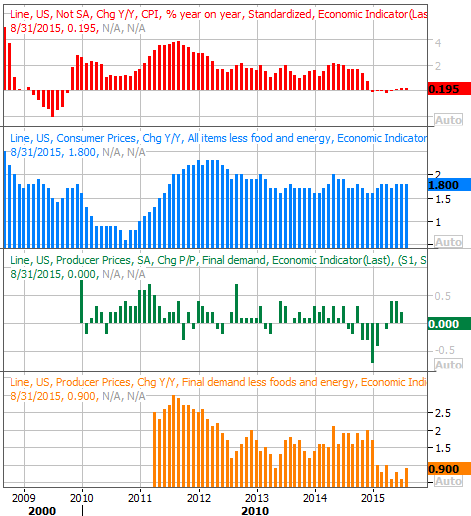

As of August, inflation remained relatively tame for everyone. The consumer inflation pace was a palatable 1.8% without counting food and energy, and was nil when factoring in food and oil/gas prices. Overall producer inflation was also non-existent with food and energy out of the picture, but still only up at an annual pace of 0.9% including everything.

Inflation Rate Chart

Source: Thomas Reuters

Also on Wednesday we’ll hear last month’s retail spending report. These figures have been ok of late, but never sizzling. Economists are looking for weakness on this front for last month too, with expectations for overall growth of only 0.2%, and a decline in retail sales of -0.1% when taking automobiles out of the picture.

Leave A Comment