Beat Expectations, Stock Falls Anyway

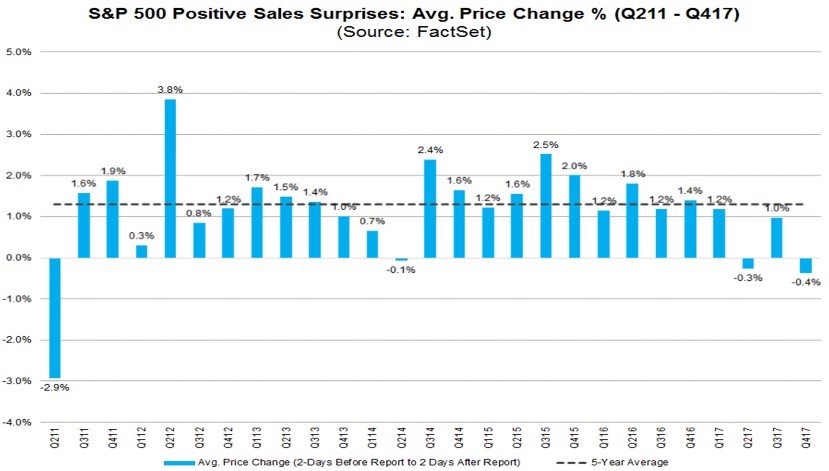

In the Q2 2017 earnings season, the market was acting weirdly. Stocks were falling when firms were beating sales expectation. My guess was that stocks priced in great results, so investors weren’t enamored after results were beat. In the Q1 2018 earnings season we’re seeing the same phenomena occur. As you can see from the chart below, the 4 day movement (2 days before report and 2 days after report) on stocks which beat revenue estimates was -0.4% this quarter. The 5 year average gain is 1.3%. The firms which missed estimates saw their stocks decline 1.2% which was 0.1% worse than average. Essentially, it was an average quarter for firms that missed, but way below average for firms that beat. My guess on why this occurred is that this quarter was a throw away one as investors were more focused on next year’s results which should be helped by the tax cuts.

Another possibility is that the market simply did bad when firms reported. The market fell because the short volatility trade unwound as traders temporarily ignored the great earnings results. During the correction 41% of companies reported results. Keep in mind, the metrics on firms missing results is much less useful than other quarters because so few missed. 77% beat sales guidance which is the best since FactSet started the calculation in Q3 2008. FactSet also cites the high price to sales ratio, which was 2.2 during the quarter and 2.1 now, as a reason stocks did poorly after beats. My contention with that metric is firms have very high margins which justifies the high sales multiple. Some investors, particularly those who follow the Shiller PE, believe margins always mean revert, but clearly stocks will only fall until there’s evidence of declining margins.

Earnings Will Drive Stocks Up

It’s critical to recognize that earnings don’t cease to be important out of the earnings season. If an investor is looking to start a position in an individual name, the first aspect he/she will review is the recent earnings results. Sometimes short term noise gets in the way of the fundamentals, but in the long run, earnings are what matters. It’s very easy to get caught up with the news of the day. It can be important to your life, but ultimately you need to ask the tough question of whether it will impact earnings results.

Leave A Comment