Extreme Optimism Leads To A Small Decline In Stocks

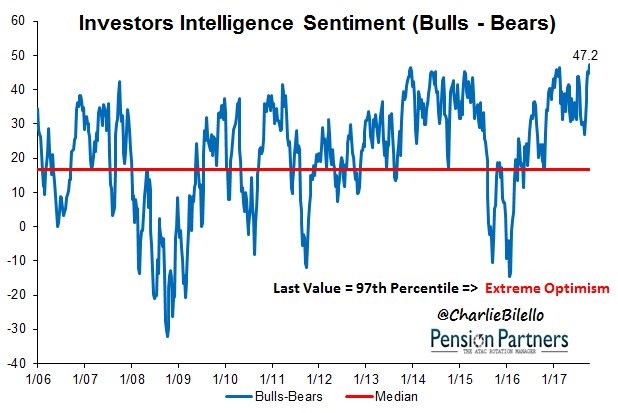

The market finally took a breather on Wednesday. It wasn’t a major sell-off because dip buyers appeared mid-day. It was healthy to see because the run had gotten ridiculous. The S&P 500 fell 0.47%. It was driven lower by weak Chipotle earnings and poor AMD guidance. AMD stock fell 13.5% and Chipotle fell 14.6%. The chart below shows support for the argument that the market was overheated. As you can see, the investors intelligence sentiment survey showed the bulls outnumbered the bears by 47.2% which was the highest reading since 1987. It’s a great summary of the market for it to sell off less than 1% compared to the crash seen in October 1987. In this market a 2% selloff in a day is unheard of while the October 19th, 1987 crash had a 22% drop in the Dow. It’s a stark comparison between one of the most volatile periods in market history to one of the least volatile periods. I maintain my bullish leanings despite the high optimism because that can easily drop off with a few more days like today. The temporary drop in optimism at the end of the chart occurred without a 3% correction. That’s why I wouldn’t worry too much about the current complacency in the market.

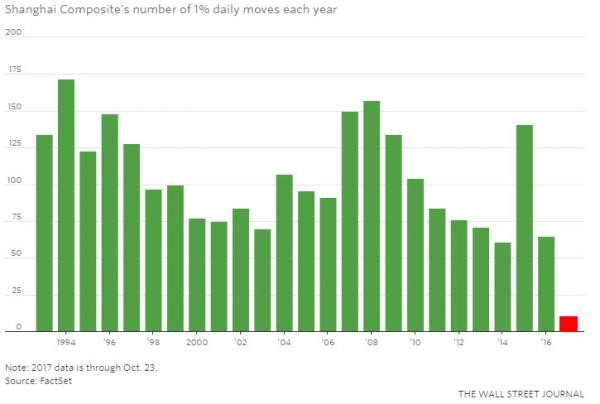

I haven’t been focused on the near term trading action in the Shanghai composite as much as the American markets. The chart below shows China is also seeing volatility suppression in their markets in 2017. As you can see, the Shanghai composite has had less than 25 days with moves over 1%. Since 1993, there hadn’t been a year with less than 50 days of 1% moves. It appears 2016 was the year of negative rates and 2017 is the year volatility died in many global markets.

The chart below shows an updated realized volatility for the S&P 500 in October. Almost every month appears to have less volatility than the previous one. The yellow line shows that every month this year has had below the historical average realized volatility as the streak below 10% continues. The realized volatility of slightly above 3% in October will be the third lowest month in history. The selloff today might impact this slightly, but it was hardly a crash. We still have the Fed pick, QE, and earnings to get through by the end of the month which can spoil this placid market.

Leave A Comment