I’m a big fan of owning a global financial asset portfolio consistent with something resembling the Global Financial Asset Portfolio (though, I would also add that this portfolio isn’t necessarily ideal).¹ If you’re a U.S. investor this has looked like a pretty silly idea in the last few years as foreign stocks have been poor performers in relative terms. Despite this short-term performance there is widespread evidence that a global portfolio is ideal (this is one of the rare cases where I disagree with John Bogle who has a healthy dose of home bias in his views).² Home bias is a common result of excessive short-termism and usually occurs after periods of recent strong relative performance.

To highlight this point I want to discuss a common reference point about owning stocks – Japan. One of the most common arguments against owning stocks for any extended duration is that Japan’s equity market has been a terrible performer for over 25 years. And it’s true. In local currency terms someone who invested ¥10,000 in the TOPIX 1,000 at the end of 1998 has just shy of ¥5,400 today. Dreadful.

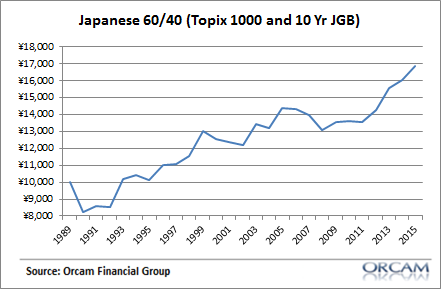

Owning one asset class isn’t “diversification” so focusing on Japanese stocks is just cherry picking. Japanese bonds have been huge performers over this time period as deflation and disinflation has set-in. The 10 year JGB has averaged an annual return of 4.9% over this period. So, a Japanese investor who purchased a simple 60/40 (60% Topix 1,000 and 40% 10 Year JGB) did much better over the same 25 year period with a compound annual growth rate of 2%.³

But what if that Japanese investor had not had any equity home bias in their portfolio? What if they’d taken that 60/40 and split the equity piece up in 50% Japanese stocks and 50% foreign stocks while maintaining the 40% JGB bond slice? In other words, what if they’d allocated to 30% Topix, 30% MSCI All World Ex-Japan and 40% 10 Yr JGBs? They would have generated a 5.2% compound annual growth rate. Not bad.

Leave A Comment