The last chance to avoid a full-blown 2019 trade war may come later this month when President Trump is scheduled to meet with Chinese President Xi Jinping at the G-20 Buenos Aires summit in the city of Buenos Aires, Argentina. It will be the first-ever G-20 summit to be hosted in South America and could be one of the most significant meetings in quite some time — as both leaders will try to resolve trade disputes.

Given the recent US record on trade, sanctions, and other forms of economic warfare, it is our opinion that the meeting will result in a wash. The net effect of this ‘wash’ will be that the possibility of a full-blown trade war with China remains, but the risk won’t go up or down. It seems that from a foreign policy/economic standpoint, the goal right now is to push everything towards the brink, but not over it. Key word – destabilization. Why would such a strategy even be considered in the first place? There are a lot of possible answers. We see the continued fleecing of naive, unaware sheep, with one of the main prizes yet to be taken – American retirement assets.

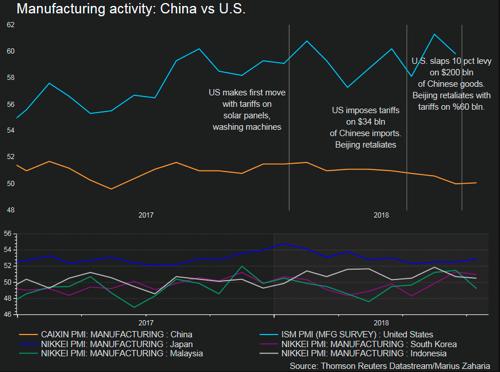

Right now, the economic impact of the escalating trade war between Washington and Beijing seemed to deepen last month as factory activity and export orders dove across Asia, with some analyst warning Reuters that the worst has yet to come.

New data earlier this week showed exporters and factories came under severe pressure, as manufacturing surveys showed some growth in China, but a rapid slowdown in South Korea and Indonesia and a straight out contraction in activity in Malaysia and Taiwan.

Those data points followed weak industrial production numbers from Japan and South Korea on Wednesday.

Much anxiety was seen by computer and human traders on Thursday, as U.S. Treasury bonds fell after data suggested a slowdown has now washed ashore into U.S. manufacturing, construction, and productivity.

The Institute for Supply Management (ISM) said its index of national factory activity declined to a six-month low of 57.7 points last month from 59.8 in September. A reading above 50 indicates growth in manufacturing, which accounts for about 12% of the U.S. economy.

Leave A Comment