This bull market seems unstoppable.

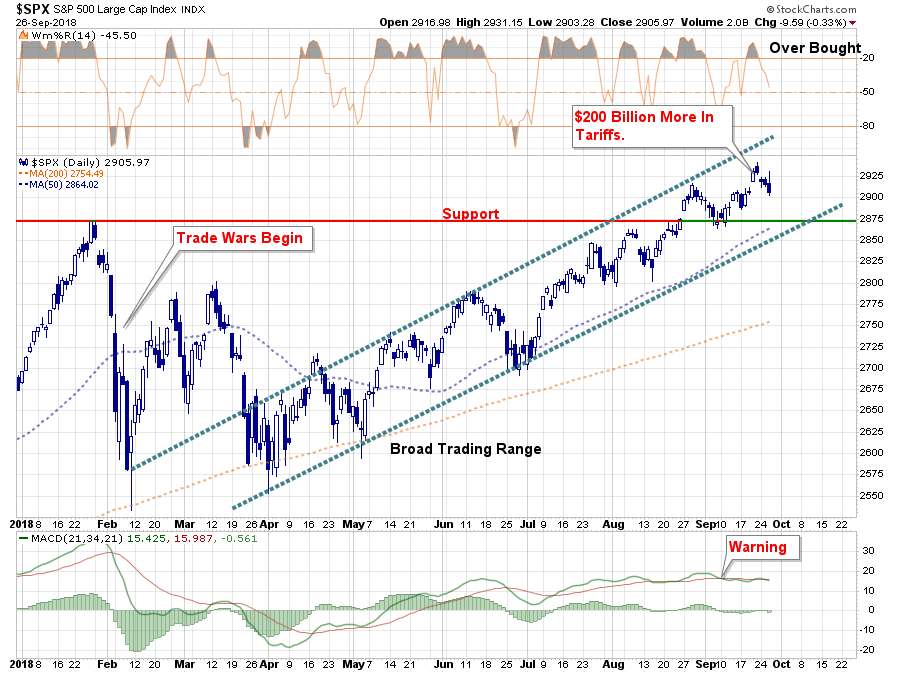

Regardless of short-term events, investors have quickly looked beyond those risks to in a bid to push stock prices higher. For example, in February of this year the markets dove roughly 10% as “trade wars” became a “thing.” Over the next two months, the markets vacillated coming to grips with what “Trump’s war with China” would actually mean. Last week, the Administration announced a further $200 billion in tariffs against China, China cancels talks with the U.S., and China imposes similar tariffs against the U.S. – and the market barely budges..

Seemingly, nothing can derail this bull market which is now the “longest in history” by some counts.

However, in my opinion, the two biggest threats to the bull market may very well be the two issues which are the most visible currently – tariffs and interest rates.

Tariffs

One of the biggest drivers of the “bullish thesis” is the explosion in earnings due to the tax cuts passed in December of 2017. However, the issue is that tax cuts only provide a very short-term benefit and, since we compare earnings on a year-over-year basis, growth will drop back towards the growth rate of the economy next year.

For now, the issue has been overlooked due to the surge in earnings from the changes to the tax code as well as the massive surge in repatriated dollars from overseas due to that lower tax rate. As shown by the Federal Reserve:

“Balance of payments data show that U.S. firms repatriated just over $300 billion in 2018:Q1, roughly 30 percent of the estimated stock of offshore cash holdings. For reference, the 2004 tax holiday, which provided a temporary one-year reduction in the repatriation tax rate, resulted in $312 billion repatriated in 2005, of an estimated $750 billion held abroad.”

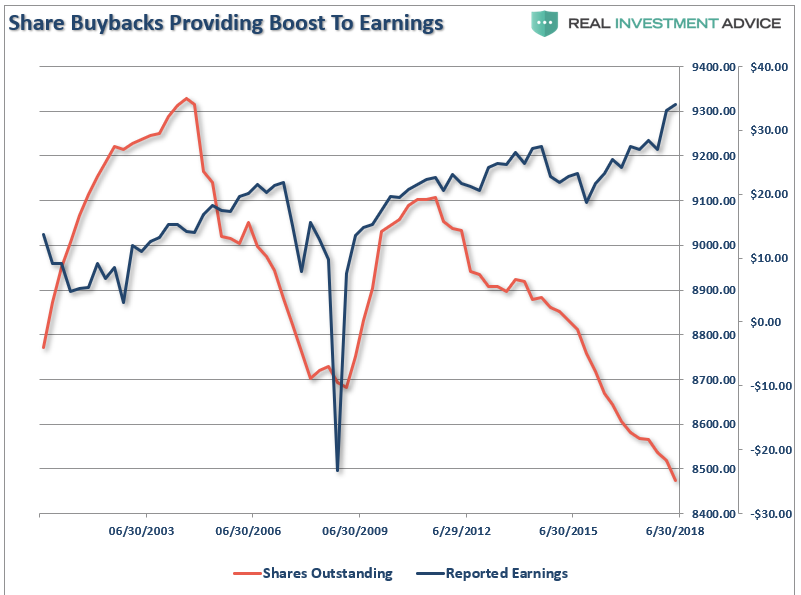

Of course, while it was expected to go to CapEx and wages, it went to share buybacks instead.

“The top 15 firms account for roughly 80 percent of total offshore cash holdings, and roughly 80 percent of their total cash (domestic plus foreign) is held abroad. Following the passage of the TCJA in late December 2017, share buybacks spiked dramatically for the top 15 cash holders, with the ratio of buybacks to assets more than doubling in 2018:Q1.”

Not surprisingly, since buybacks reduce the number of shares outstanding, bottom line EPS surged sharply despite a quarterly decline in revenues/share which slumped from $329.59/share in Q4 to $320.39/share in Q1.

While the bull market thesis continues to be that earnings expansion will justify higher valuations, such may not be the case. Tariffs, which are a “tax on profits,” could effectively eliminate the majority of the temporary benefits provided by tax cuts to begin with.

Leave A Comment