In my latest article, I’ve highlighted 4 popular dividend stocks to sell. As I wrote at the end of this article, I don’t appreciate when people criticize without bringing something on the table. For this reason, I’m offering you 4 interesting stock picks for 2017 that could easily replace the other bad seeds.

Honeywell International (HON)

Business model:

Honeywell invents and manufactures technologies to address some of the world’s toughest challenges initiated by revolutionary macrotrends in science, technology and society. The company evolves in three different industries: Aerospace & Transportation, Automation & Control system, Materials & Chemicals. The company recently combined the aerospace and the transportation segment in order to improve scaling economy.

Main strengths:

The company has put additional focus on software engineering with nearly 11,000 engineers working on software instead of more classic industrial goods. The software business is better as it enables more combinations of services and drives higher margins. Honeywell certainly has some solid ground for future growth.

Potential risks:

While margins improvements were quite phenomenal, we can’t expect to see the company keeps increasing its margins. Therefore, further numbers shouldn’t be that impressive. Also, HON automation segment may suffer from the oil and gas industry slump.

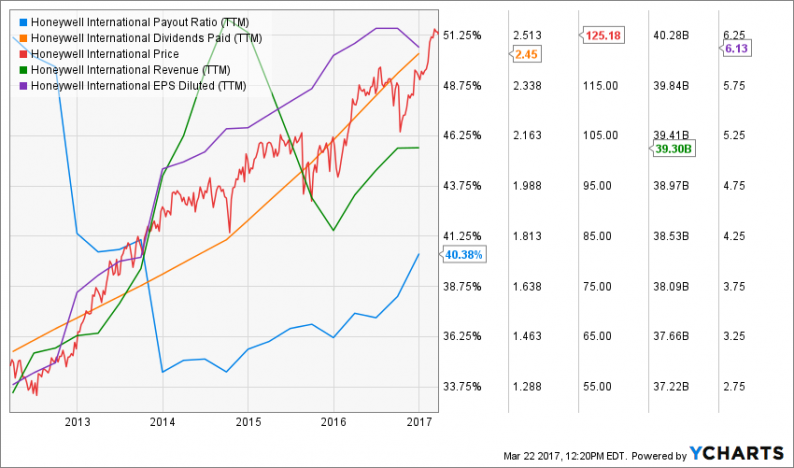

Dividend growth perspective:

management had announced last year that the dividend payout ratio will increase in the upcoming 4 years. In 2015, the dividend payment increase was of 15% and 11.76% in 2016. I’m not putting on my pink colored glasses and expecting a 12% dividend growth for the next 10 years, but I can appreciate the growth will be significant for several years to come.

Investment thesis:

Honeywell has made impressive efforts to improve their internal practices over the past 15 years after failing to merge with General Electrics (GE). Those efforts paid well as the company operating margins improved from 7.6% in 2004 to 15.2% in 2014. Those impressive margin increase lead HON EPS to increase by 10% in 2015 as the company is facing a challenging economy. The company was also able to increase its dividend by 10% CAGR over the past 5 years. HON is a leader in the aerospace control and safety systems and should benefit from its leadership position during the commercial aircraft upcycle.

Valuation:

Source: Dividend Monk Toolkit Excel Calculation Spreadsheet

Lowe’s (LOW)

Business model:

Lowe’s is the second-largest home-improvement retailer in the world with over $59 billion in annual revenues. Strong from its position in the U.S., Lowe’s benefits from the recent rebound of the world’s largest economy. LOW is also expanding through acquisitions as management recently closed the purchase of Rona in Canada. Lowe’s doesn’t only focus on selling you home renovation and improvement products, it also uses their experienced salesforce to provide you with additional advice. The company has also successfully built a solution-based segment within its stores. By offering a complete solution from start to finish, Lowe’s make sure to “capture” the customer for its entire project purchases.

Leave A Comment