Trade War Potentially Simmers Down

It’s shocking how the trade war situation worked out. The futures market looked weak on Monday night. It seemed inevitable that China would match the tariffs President Trump announced.

However, that’s not what happened. China announced it would tax $60 billion worth of American goods between a 5% and 10% rate effective on September 24th.

The list of American goods being taxed includes 5,207 products. There’s no guarantee that China will not add to the tariffs in the next few weeks. For now, it looks like China isn’t responding in kind.

If President Trump keeps up his tariff threat, raising the rate to 25% and increasing the tariffs to $267 billion worth of goods because China retaliated, China might give in.

In a game of chicken, if both sides are strongly ready to uphold their threat, it could end in disaster. The minute one side shows weakness, the stronger player can up the ante, causing the weaker player to give in.

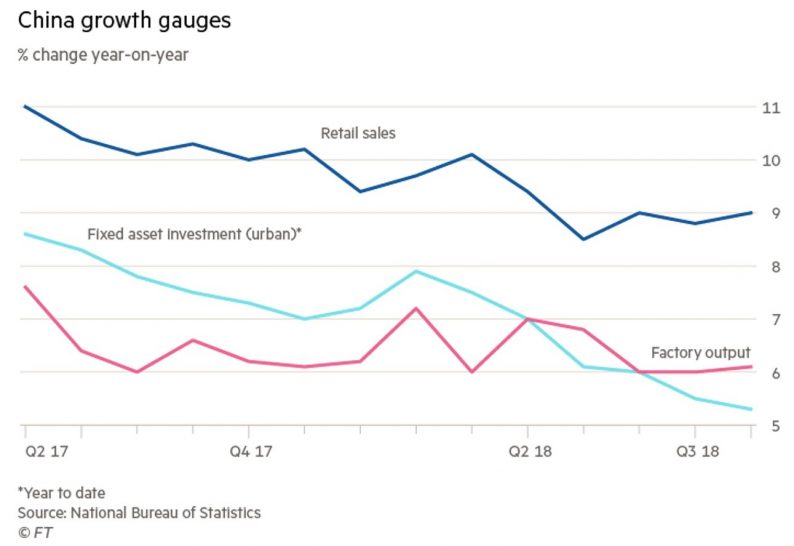

As you can see from the chart below, there’s a good reason for China to give in to Trump’s demands.

The Shanghai Composite is at the lowest point since 2014. Retail sales, fixed investment, and factory output are all seeing decelerating growth.

Fixed investment growth in the first 8 months of the year was 5.3% which is the lowest growth since at least 1995. The growth rate has hit a new low in 5 consecutive months. Tariffs will cause pressure on Chinese exports, furthering the deceleration of the economy.

Trade War – Stocks Increase Sharply On Tuesday

The market interpreted the Chinese tariffs on American goods as the beginning of the end of the trade war.

It’s very difficult to predict where stocks will go in the near term because if the trade war is seen to be getting worse, stocks can fall about 5%.

If China adds more goods to its list and raises the tax rate because its latest action is seen as weak, investors will quickly lose optimism. If Trump presses China and it gives in, stocks could rally about 5%.

Leave A Comment