S&P futures are unchanged and Asian stocks closed mixed, however European stocks rebounded for first time this week, led by auto stocks after Daimler’s quarterly profit, as a break in alarming political news prompted traders to “swoop” – as Reuters puts it – on equities, cooling a safe-haven rally that saw the yen and gold at five-month highs and global government bond yields to drop their lowest this year.

Still, with many geopolitical unknowns in the days ahead as well as potential military escalation in North Korea, the mood remained “skittish”, and meant that what looked set to be oil’s longest winning run since August – up for 8 consecutive days, its longest streak in 2017 – has largely gone under the radar.

As DB’s Jim Reid puts it, it has felt quite quiet and orderly this week considering the risk-off tendencies and relatively big spike in volatility. However that might be because of a lack of activity given the pending Easter break. So poor liquidity is probably exacerbating the moves. Add to this the rising geopolitics tensions (North Korea, Syria), slow burning ongoing concerns about Trump trades post the healthcare debacle, and a steady increase of support for Melenchon in the recent French polls making it less certain who’ll contest the final round run-off. For now equity and credit markets remain fairly resilient which reduces the immediate worry but if vol remains elevated at these levels for a few days expect weakness.

This morning in Asia we got the latest inflation data out of China. In terms of the numbers, PPI in March has moderated somewhat after dipping two-tenths to +7.6% yoy (vs. +7.5% expected) following a bit of a levelling out in commodity prices. That said it also marks the seventh consecutive monthly positive print after 54 months of deflation in prices at the factory gate. Meanwhile CPI has edged up one-tenth to +0.9% yoy although did miss slightly relative to expectations for +1.0%, with a -4.4% yoy decline in food prices in particular having an impact.

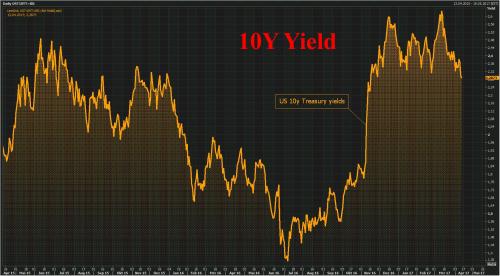

Bourses in China are a touch weaker although that is the case for much of Asia this morning, if not the rest of the world. Global markets halted their recent declines with an early 0.3 percent rise for Europe’s STOXX 600 share index put it on course for its best day of the month. The rise in oil underpinned energy stocks while banks and carmakers also made ground. MSCI’s broadest index of Asia-Pacific shares outside Japan saw a late rally though Shanghai closed down 0.4 percent as China reported a slight slowdown in producer price inflation. South Korean stocks and the won gained for the first time in seven days. Hong Kong equities erased losses to rally in late trading. The yield on 10-year U.S. notes rose after closing Tuesday below 2.3 percent for the first time in four months. Oil extended its longest winning streak since December. Japan’s Topix fell to the lowest level of the year after the yen breached 110 yen per dollar for the first time since November on Tuesday. A quick breakdown from Bloomberg:

At the same time, volatility is easing after the VIX climbed to a level unseen since November on Tuesday amid escalating global tensions.

“It is a modest rebound,” said Rabobank strategist Philip Marey. “We have discounted much of the news like the conflict between the Americans and the Russian on Syria and Trump’s tweets on North Korea, so maybe its time to move on.”

S&P 500 futures are unchanged, having spent the Asian session in the red. Japan’s Nikkei had slid just over 1 percent as a rising yen weighed on exporters’ shares.

However, while stock traders are hoping to BTD, the allure of save havens persists with gold climbing as far as $1,280.30 at one stage, its highest since Nov. 10, while the 10Y TSY was at 2.30% at last check, flirting with the key support ling that has emerged since the Trump election, after dropping to 2.28% overnight.

“A degree of uncertainty has found its way into previously seemingly bulletproof financial markets,” wrote analysts at ANZ.”There is clearly some nervousness out there, with tensions around North Korea ratcheting higher and adding to an already heightened geopolitical environment. Global cyclical assets have not yet responded, but that can’t last.”

In geopolitics, Chinese President Xi Jinping on Wednesday stressed the need for a peaceful solution for the Korean peninsula on a call with U.S President Donald Trump. North Korea has warned of a nuclear attack on the United States at any sign of aggression as a U.S. Navy strike group steamed toward the Korean peninsula – a force Trump described as an “armada”. Japan’s navy also plans joint drills with the U.S. force, sources told Reuters. Trump said in a Tweet that North Korea was “looking for trouble” and the U.S. would “solve the problem” with or without China’s help.

The bellicose language has dragged South Korean stocks and the won to four-week lows and caused jitters across Asia. At the same time, U.S. Secretary of State Rex Tillerson was in Moscow to denounce Russian support for Syria’s Bashar al-Assad, raising the stakes in the Middle East. A joint news conference by Trump and NATO Secretary General Jens Stoltenberg was also likely to generate headlines.

Leave A Comment