Last week’s deep dive in Treasury yields continued to reverse course yesterday, offering a reprieve to the aggressive risk-off posture that’s been roiling markets lately. Today’s twin updates on US industrial production and housing construction for January will help determine if the crowd’s latest round of optimism is warranted. But for the moment, it’s clear that the bond market is having second thoughts about the wisdom of pricing in high odds of new recession. Until further notice, the feeling is mutual over in equity-land as of yesterday’s sharply higher close.

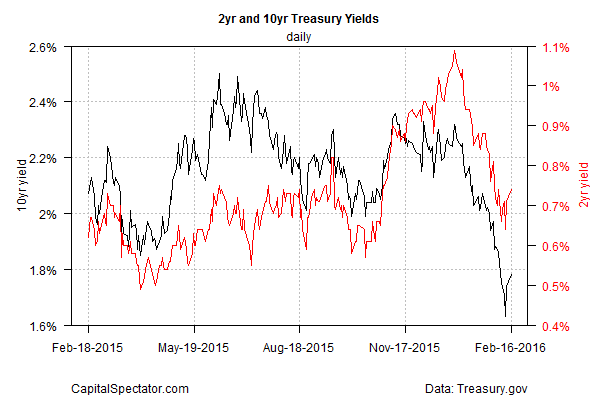

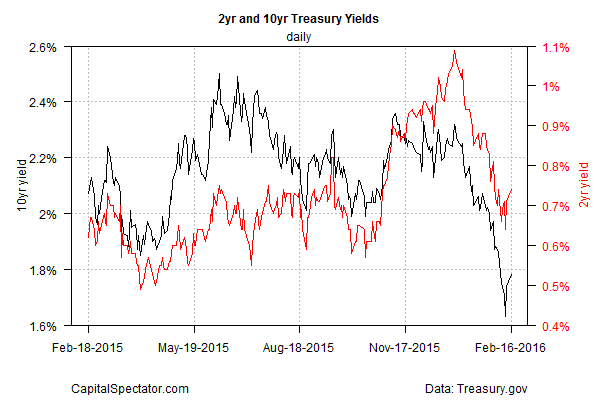

The benchmark 10-year yield bounced again on Monday (Feb. 16), rising to 1.78%–the highest since Feb. 5, based on daily data via Treasury.gov. Meanwhile, the 2-year yield—considered the most sensitive spot on the yield curve for rate expectations—increased above the 0.40% mark on Monday for the first time in three trading sessions. Yields remain subdued relative to recent history, but for the moment the free fall has ended. It’s anyone’s guess if the bearish momentum has burned itself out, although the last several days offer a bit of cautious optimism for thinking that the deep dive in yields has run its course.

The market’s inflation expectations have also rebounded a bit after tumbling to seven-year lows earlier this month. The implied inflation forecast via the yield spread on the nominal 10-year Treasury less its inflation-indexed counterpart held steady at 1.25% for the second trading day in a row through yesterday. That still represents a sharp reduction in expectations vs. the roughly 1.60% yield spread from last November—or the 2.20%-plus readings in 2014! But if the Treasury market has been projecting heightened deflation risk lately, the crowd has decided to cool its jets for the moment and wait for new economic data before deciding on what happens next.

On that note, economists are looking for a round of upbeat numbers in today’s reports on housing starts and industrial production, based on Econoday.com’s consensus forecasts. New residential construction is projected to rise to 1.175 million units (seasonally adjusted annual rate) in the January update–near the post-recession high of 1.211 million that was touched last June. A more dramatic increase is expected for industrial activity: analysts are looking for the first monthly rebound in output since last August. But even if the forecast holds, the year-over-year trend for industrial activity will remain negative for the third month in a row.

Leave A Comment